HSBC Multi Asset Allocation Fund

(An open ended scheme investing in Equity & Equity Related instruments, Debt & Money Market Securities and Gold / Silver ETFs.)

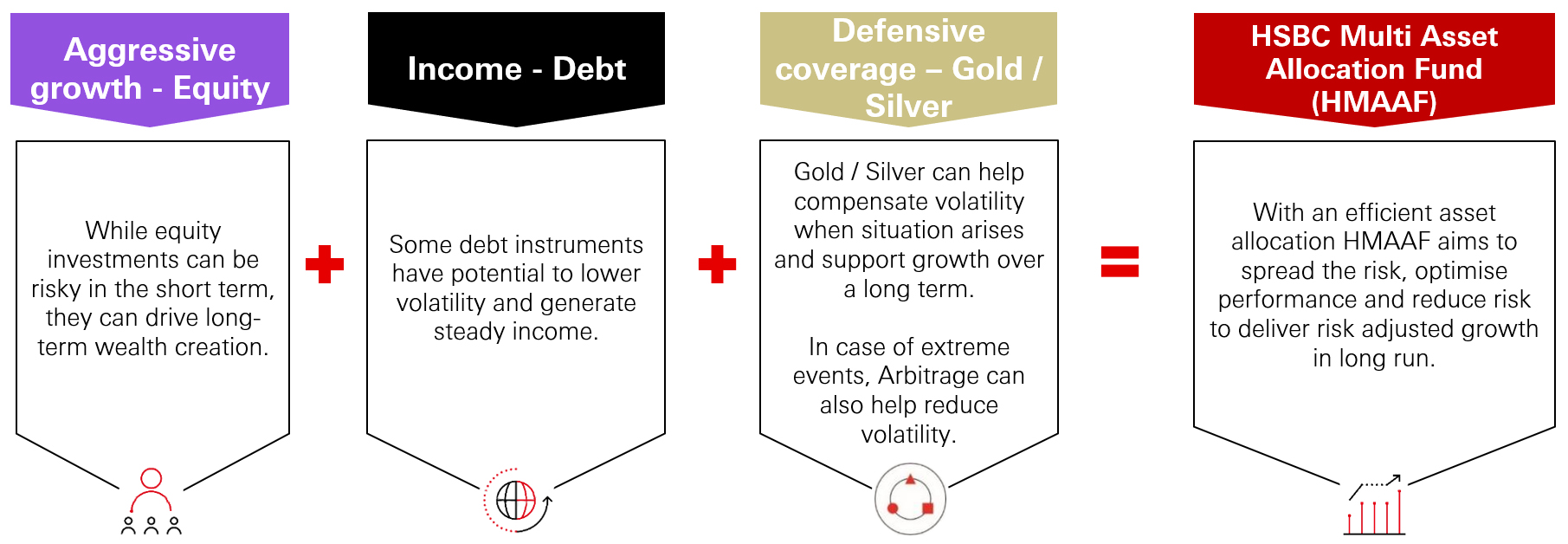

Equity markets have delivered strong performance during positive market situations but also corrected sharply during major events such as Sub-prime and Corona virus led global lockdown. During such events, asset classes such as Gold or Debt have compensated for negative equity performance. Long-term investment and goal planning insists for more than a single asset and needs Multi Asset Allocation ability.

Investment Objective

The aim of the fund is to generate long-term capital growth and generate income by investing in Equity & Equity Related instruments, Debt & Money Market Securities and Gold / Silver ETFs. However, there can be no assurance or guarantee that the investment objective of the scheme would be achieved.

Benchmark (Tier 1)

S&P BSE 200 TRI (65 per cent) + NIFTY Short Duration Debt Index (20 per cent) +Domestic Price of Gold (10 per cent) +Domestic Price of Silver (5 per cent)

Investment Strategy

The fund aims to capitalise on an optimum Multi Asset Allocation investment strategy

Our philosophy

- Follow investment mandate

- Active Fund Management

- Research based stock selection

- Robust risk management

Our process

Proprietary research drives stock selection:

Power of SAPM - Equity investment process comprises three stages

- Selection of Ideas

- Analysis of Companies

- Portfolio Creation and Monitoring

Why HSBC Multi Asset Allocation Fund?

- With an efficient asset allocation HSBC Multi Asset Allocation Fund aims to spread the risk across three major asset classes i.e. Equity, Debt and Gold/Silver risk to deliver fair risk adjusted growth in long run

- HMAF’s typical equity allocation may range between 65 per cent to 80 per cent

- The fund aims to follow blended i.e. Top-down + Bottom-up approach and blended Growth and Value style investing

- General Debt allocation of the fund is likely to be around 10 per cent to 25 per cent

- Aims to invest in high quality assets including GOI securities, Corporate bonds, Money market instruments to generate alpha with active duration management

- The fund also aims to allocate around 10 per cent to 25 per cent to Gold/Silver to compensate for volatility and support long term growth

- In case of extreme events the fund may explore Arbitrage opportunities to help reduce volatility and improve overall performance

- Asset re-allocation could be undertaken basis changes in a market / asset class outlook of the Fund House

| Scheme Name | Scheme Risk-o-meter | Benchmark Risk-o-meter |

|---|---|---|

|

HSBC Multi Asset (An open ended scheme This product is suitable for equity related securities, fixed income instruments and Gold / Silver ETFs |

Investors understand |

S&P BSE 200 TRI

NIFTY Short Duration Debt Index

Domestic price of gold

Domestic price of silver

S&P BSE 200 TRI (65%) + |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Product labelling assigned during the NFO is based on internal assessment of the scheme characteristics or model portfolio and the same may vary post NFO when the actual investments are made.

Read more

Begin your journey here

Looking to dream big? Start your journey here.