Booklet - HSBC Consumption Fund

HSBC Consumption Fund

Consumption Fund - An open ended equity scheme following consumption theme

India is broadly where China was in CY06. Since then, China has seen explosion in consumption spends across categories and we believe that India will follow similar path. India is favorably positioned due to its demographics, formalization of economy, increase women participation in workforce etc. Aspirational Indian are more tech savvy and influenced by social media and ready to spend now than later through use of credit. We are witnessing consumption shifting from unorganized to organized, premium categories and consumer behavior moving towards buying everything anywhere. This should drive strong consumptions spends in the coming decade. HSBC India Consumption fund will aim to capture this strong underlying growth trends in the country.

Investment objective

The investment objective of the Fund is to generate long-term capital growth from an actively managed portfolio of equity and equity related securities of companies engaged in or expected to benefit from consumption and consumption related activities. However, there can be no assurance or guarantee that the investment objective of the scheme will be achieved.

Benchmark Index (Tier 1)

Nifty India Consumption Index TRI

The Nifty India Consumption Index is designed to reflect performance of a diversified portfolio of companies representing the domestic consumption sector which includes sectors like Consumer Non-durables, Healthcare, Auto, Telecom Services, Pharmaceuticals, Hotels, Media & Entertainment, etc. The Nifty India Consumption Index comprises of 30 companies listed on the National Stock Exchange (NSE).

The Scheme is being benchmarked against the Index mentioned above, since the composition of Index is in line with the investment objective of the Scheme and is most suited for comparing performance of the Scheme.

Investment strategy

Our philosophy

- Follow investment mandate

- Active Fund Management

- Research based stock selection

- Robust risk management

Our process

Proprietary research drives stock selection:

Power of SAPM - Equity investment process comprises three stages

- Selection of Ideas

- Analysis of Companies

- Portfolio Creation and Monitoring

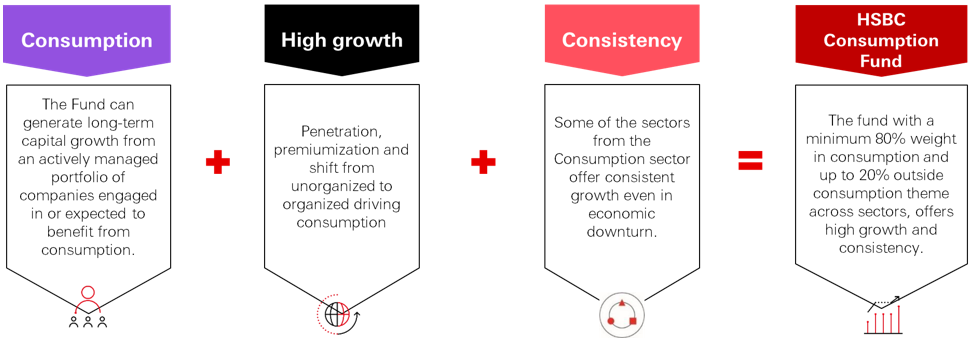

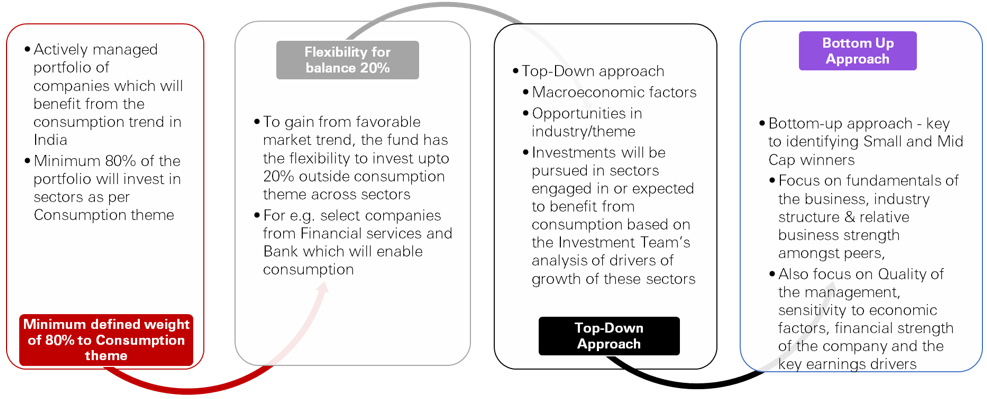

Why HSBC Consumption Fund?

- The Fund can generate long-term capital growth from an actively managed portfolio of companies engaged in or expected to benefit from consumption

- Some of the sectors from the Consumption sectors have potential to offer consistent growth even in economic downturn

- The fund with a minimum 80 per cent weight in consumption index and up to 20 per cent outside its benchmark where key consumption enablers will be in focus can offer high growth and consistency over a long term.

The changing consumption trend in India

5 factors that will drive consumption

Consumption History Repeats Itself

Growth of various sectors and sub-sectors led by evolving consumption theme

Performance & returns of Consumption Index

HSBC Consumption Fund – Factors/drivers for consumption growth in India, key features & benefits

Hindi IAP Infographic - Consumption 1

Hindi IAP Infographic - Consumption 2

Hindi - Consumption Fund Product Note

Tamil IAP Infographic - Consumption 1

Tamil IAP Infographic - Consumption 2

Tamil - Consumption Fund Product Note

Bengali IAP Infographic - Consumption 1

Bengali IAP Infographic - Consumption 2

Bengali - Consumption Product Note

Gujarati IAP Infographic - Consumption 1

Gujarati IAP Infographic - Consumption 2

Gujarati Consumption Product Note

|

HSBC Consumption Fund (An open ended equity scheme following This product is suitable for investors who are seeking*: equity related securities of companies engaged in or expected to benefit from consumption and consumption related activities As per AMFI Tier I Benchmark i.e. Benchmark : Nifty India Consumption Index TRI |

|

|

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them. Note on Risk-o-meters: The risk-o-meter is as per the product labelling of the Scheme available as on the date of this communication/disclosure Any change in risk-o-meter shall be communicated by way of Notice cum Addendum and by way of an e-mail or SMS to unitholders of that particular scheme.

Visit this link and check the latest Riskometer / Product Labels in the “Performance - Equity Hybrid Debt Global Funds” document of the latest month. Past performance may or may not be sustained in the future and is not indicative of future results.

Investors are requested to note that as per SEBI (Mutual Funds) Regulations, 1996 and guidelines issued thereunder, HSBC AMC, its employees and/or empaneled distributors/agents are forbidden from guaranteeing/promising/assuring/predicting any returns or future performances of the schemes of HSBC Mutual Fund. Hence please do not rely upon any such statements/commitments. If you come across any such practices, please register a complaint via email at investor.line@mutualfunds.hsbc.co.in.

This document/content is intended only for distribution in Indian jurisdiction. Neither this document nor the units of HSBC Mutual Fund have been registered under Securities law/Regulations in any foreign jurisdiction. The distribution of this document in certain jurisdictions may be unlawful or restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions. If any person chooses to access this document from a jurisdiction other than India, then such person do so at his/her own risk and HSBC and its group companies will not be liable for any breach of local law or regulation that such person commits as a result of doing so.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Read more

![]() To Transact on WhatsApp – Send us “Hi” on 9326929294 TnC

To Transact on WhatsApp – Send us “Hi” on 9326929294 TnC

![]() For Product updates on WhatsApp – Send us “Hi” on 8879900800

TnC

For Product updates on WhatsApp – Send us “Hi” on 8879900800

TnC

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Begin your journey here

Looking to dream big? Start your journey here.