HSBC Financial Services Fund

(An open-ended equity scheme investing in financial services sector)

India's financial services sector is poised for significant growth driven by country’s rapidly expanding economy, offering immense opportunities for wealth creation. With increasing financial inclusion, rapid digital transformation and progressive regulatory reforms, the sector is evolving into a dynamic ecosystem that supports diverse financial needs.

From banking and insurance to asset management and fintech, the sector is poised for exponential growth, making it an attractive avenue for investors seeking long-term value. The banking sector is considered the backbone of the Indian economy, playing a crucial role in economic growth and development whereas the financial services sector is on a growth trajectory, driven by increasing financial inclusion, digitaisation and supportive regulatory policies. These factors contribute to the potential for robust growth in the sector, making it an attractive proposition for investors seeking to capitalise on the sector's performance.

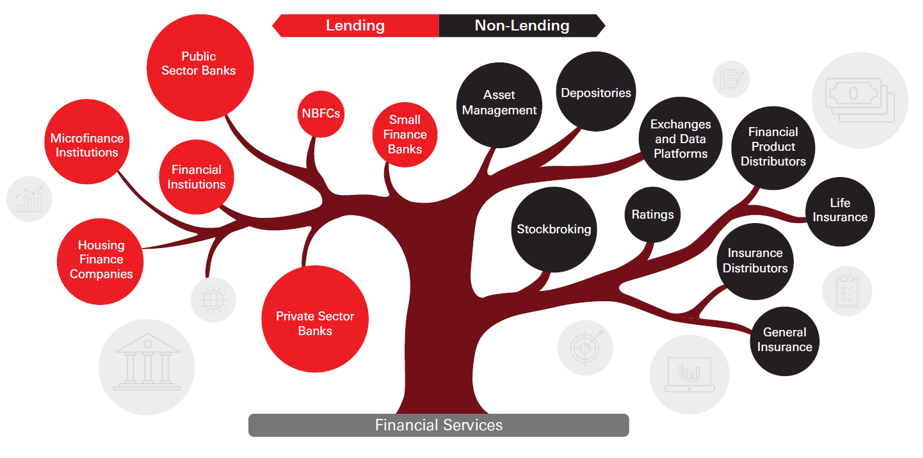

Financial services sector offers diverse collection of growing themes

Investment Objective

The investment objective of the scheme is to generate long-term capital appreciation from a portfolio that is invested predominantly in equity and equity related securities of companies engaged in financial services businesses. There is no assurance that the investment objective of the scheme will be achieved.

Portfolio construction approach

Our philosophy

- Follow investment mandate

- Active Fund Management

- Research based stock selection

- Robust risk management

Our process

Proprietary research drives stock selection:

Power of SAPM - Equity investment process comprises three stages

- Selection of Ideas

- Analysis of Companies

- Portfolio Creation and Monitoring

Why HSBC Financial Services Fund?

- Financial sector is expected to grow 2x of GDP to achieve the Viksit Bharat ambition

- The share of financial assets within the overall Indian households mix has been increasing

- Technology has reformed the financial landscape – Smartphone penetration, lowest data cost led to increase in active internet user

- Government initiatives have accelerated the pace of growth in the sector – UPI, Aadhaar, GST, Digilocker and ONDC are some of the major enablers for the improved prospects of financial services sector

- Change in behaviour of Indians – Risk averse to Return focused approach is driving investments towards assets such as Equity, Mutual Funds

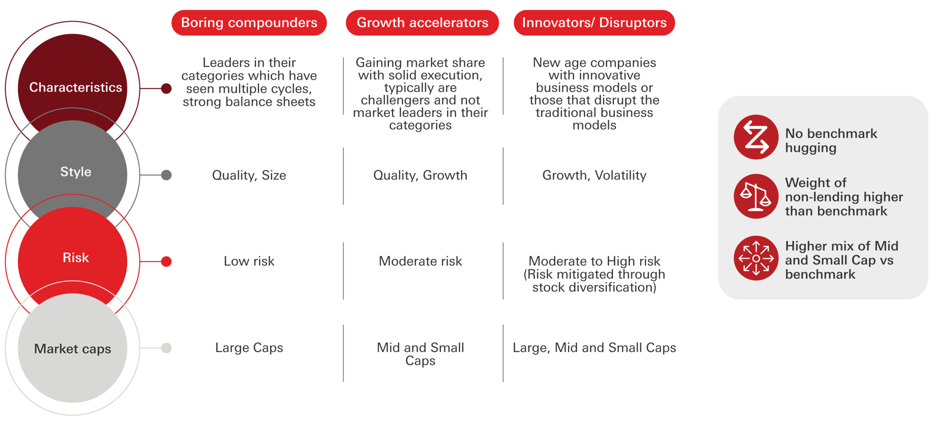

- HSBC Financial Services Fund may have more allocation to non-lending themes such as Capital Market, Mutual Funds, Insurance, Wealth Management, Depositories, etc.

- The fund may not follow benchmark hugging strategy to create a differentiated portfolio which may have potential for growth

- Also aims to have higher weightage to Mid-Small Cap segment compared to benchmark

|

HSBC Financial Services Fund (An open ended equity scheme investing in financial services sector) This product is suitable for investors in financial services businesses. |

|

|

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Map Disclaimer

Source of map: www.surveyofindia.gov.in

Map of India is used for illustrative purpose only and is not a political map of India

Note – The above information is for illustrative purpose only. The sector(s)/issuer(s) mentioned in this document do not constitute any research report nor it should be considered as an investment research, investment recommendation or advice to any reader of this content to buy or sell any stocks/investments. Please refer Scheme Information Document (SID) for more details.

Source: RBI, Financial Stability Board, World Bank, Federal Reserve, Bundesbank, BCG analysis, # FICCI-IBA-BCG report titled ‘Banking for a Viksit Bharat’, RBI; MoSPI, NSE, AMFI, NPS Trsu, Tracxn, BCG analysis, TRAI, Cable.co.uk, Kantak / JM Financial & Beams Fintech Analysis Report, HSBC Mutual Fund.

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them. Note on Risk-o-meters: The risk-o-meter is as per the product labelling of the Scheme available as on the date of this communication/disclosure Any change in risk-o-meter shall be communicated by way of Notice cum Addendum and by way of an e-mail or SMS to unitholders of that particular scheme.

Visit this link and check the latest Riskometer / Product Labels in the “Performance - Equity Hybrid Debt Global Funds” document of the latest month. Past performance may or may not be sustained in the future and is not indicative of future results.

Investors are requested to note that as per SEBI (Mutual Funds) Regulations, 1996 and guidelines issued thereunder, HSBC AMC, its employees and/or empaneled distributors/agents are forbidden from guaranteeing/promising/assuring/predicting any returns or future performances of the schemes of HSBC Mutual Fund. Hence please do not rely upon any such statements/commitments. If you come across any such practices, please register a complaint via email at investor.line@mutualfunds.hsbc.co.in.

This document/content is intended only for distribution in Indian jurisdiction. Neither this document nor the units of HSBC Mutual Fund have been registered under Securities law/Regulations in any foreign jurisdiction. The distribution of this document in certain jurisdictions may be unlawful or restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions. If any person chooses to access this document from a jurisdiction other than India, then such person do so at his/her own risk and HSBC and its group companies will not be liable for any breach of local law or regulation that such person commits as a result of doing so.

Read more

![]() To Transact on WhatsApp – Send us “Hi” on 9326929294 TnC

To Transact on WhatsApp – Send us “Hi” on 9326929294 TnC

![]() For Product updates on WhatsApp – Send us “Hi” on 8879900800

TnC

For Product updates on WhatsApp – Send us “Hi” on 8879900800

TnC

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Begin your journey here

Looking to dream big? Start your journey here.