HSBC Large and Mid Cap Fund

Large and Mid Cap Fund - An open ended equity scheme investing in both large cap and mid cap stocks.

(Formerly known as HSBC Large and Mid Cap Equity Fund. L&T Large and Mid Cap Fund has merged into HSBC Large and Mid Cap Equity Fund and the surviving scheme has been renamed)

Investment Objective

To seek long term capital growth through investments in both large cap and mid cap stocks. However, there is no assurance that the investment objective of the Scheme will be achieved.

Our philosophy

- Disciplined investment approach with “fundamental research” as the foundation of our investment decision making process

- Focus on companies with an attractive combination of profitability and valuation

- Look to own scalable businesses with strong execution capability, proven management track record and strong financials

Our process

Proprietary research drives stock selection:

- Our equity investment process comprises three stages – Stock selection, Stock analysis and Portfolio construction

- Use a combination of quantitative and qualitative filters to arrive at a list of investable universe of stocks

- Evaluate stock ideas on the basis of three key parameters, namely Quality of Business, ESG and Valuation

- Portfolio construction is an outcome of the above mentioned investment process and tracked against predefined risk matrix

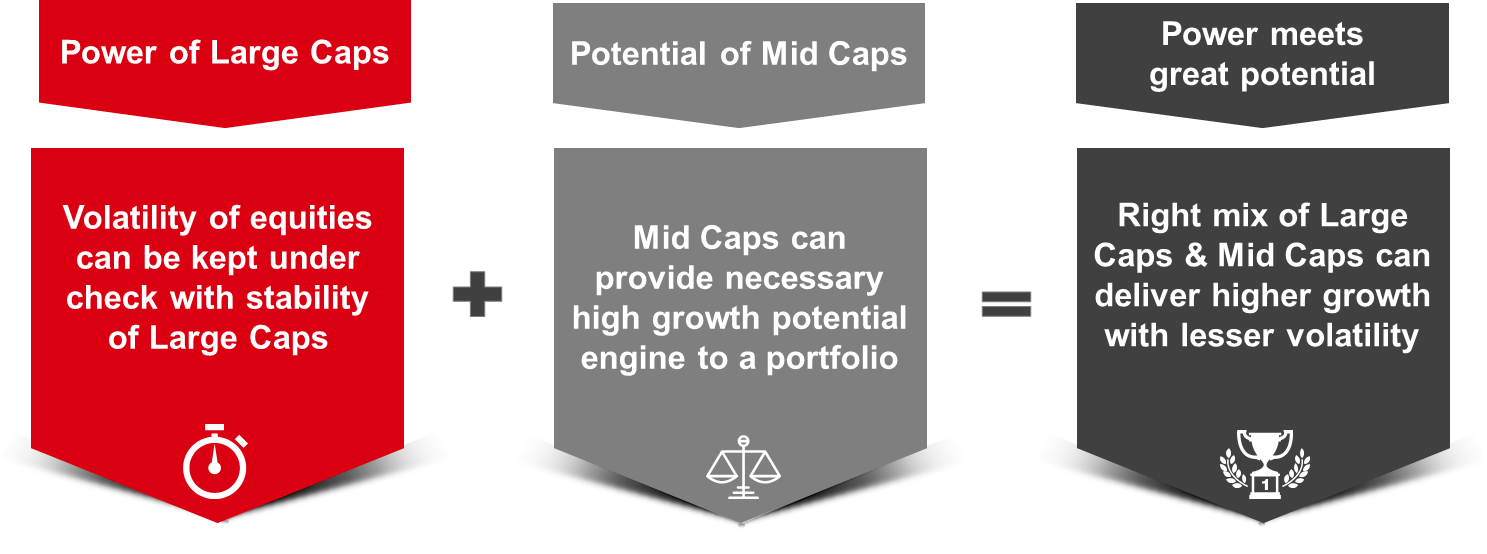

Why HSBC Large and Mid Cap Fund?

- To achieve relatively lower volatility and performance consistency with optimal allocation to large caps

- To increase the possibility of alpha generation and accelerated growth with potential of mid caps

- A top down and bottom up approach will be used to invest in equity and equity related instruments

- True to label fund – The fund will stay true to its objective in keeping with the mandate reposed by the investor whilst investing in the fund

- To create a corpus through generating inflation-adjusted returns to cater to long-term goals

|

HSBC Large and Mid Cap Fund (An open ended equity scheme investing in both large cap and mid cap stocks) This product is suitable for investors who are seeking*: As per AMFI Tier I. Benchmark : NIFTY Large Midcap 250 TRI |

|

|

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them. Note on Risk-o-meters: The risk-o-meter is as per the product labelling of the Scheme available as on the date of this communication/disclosure Any change in risk-o-meter shall be communicated by way of Notice cum Addendum and by way of an e-mail or SMS to unitholders of that particular scheme.

Visit this link and check the latest Riskometer / Product Labels in the “Performance - Equity Hybrid Debt Global Funds” document of the latest month. Past performance may or may not be sustained in the future and is not indicative of future results.

Investors are requested to note that as per SEBI (Mutual Funds) Regulations, 1996 and guidelines issued thereunder, HSBC AMC, its employees and/or empaneled distributors/agents are forbidden from guaranteeing/promising/assuring/predicting any returns or future performances of the schemes of HSBC Mutual Fund. Hence please do not rely upon any such statements/commitments. If you come across any such practices, please register a complaint via email at investor.line@mutualfunds.hsbc.co.in.

This document/content is intended only for distribution in Indian jurisdiction. Neither this document nor the units of HSBC Mutual Fund have been registered under Securities law/Regulations in any foreign jurisdiction. The distribution of this document in certain jurisdictions may be unlawful or restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions. If any person chooses to access this document from a jurisdiction other than India, then such person do so at his/her own risk and HSBC and its group companies will not be liable for any breach of local law or regulation that such person commits as a result of doing so.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Read more

![]() To Transact on WhatsApp – Send us “Hi” on 9326929294 TnC

To Transact on WhatsApp – Send us “Hi” on 9326929294 TnC

![]() For Product updates on WhatsApp – Send us “Hi” on 8879900800

TnC

For Product updates on WhatsApp – Send us “Hi” on 8879900800

TnC

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Begin your journey here

Looking to dream big? Start your journey here.