HSBC Large and Mid Cap Fund

Large and Mid Cap Fund - An open ended equity scheme investing in both large cap and mid cap stocks.

(Formerly known as HSBC Large and Mid Cap Equity Fund. L&T Large and Mid Cap Fund has merged into HSBC Large and Mid Cap Equity Fund and the surviving scheme has been renamed)

Investment Objective

To seek long term capital growth through investments in both large cap and mid cap stocks. However, there is no assurance that the investment objective of the Scheme will be achieved.

Our philosophy

- Disciplined investment approach with “fundamental research” as the foundation of our investment decision making process

- Focus on companies with an attractive combination of profitability and valuation

- Look to own scalable businesses with strong execution capability, proven management track record and strong financials

Our process

Proprietary research drives stock selection:

- Our equity investment process comprises three stages – Stock selection, Stock analysis and Portfolio construction

- Use a combination of quantitative and qualitative filters to arrive at a list of investable universe of stocks

- Evaluate stock ideas on the basis of three key parameters, namely Quality of Business, ESG and Valuation

- Portfolio construction is an outcome of the above mentioned investment process and tracked against predefined risk matrix

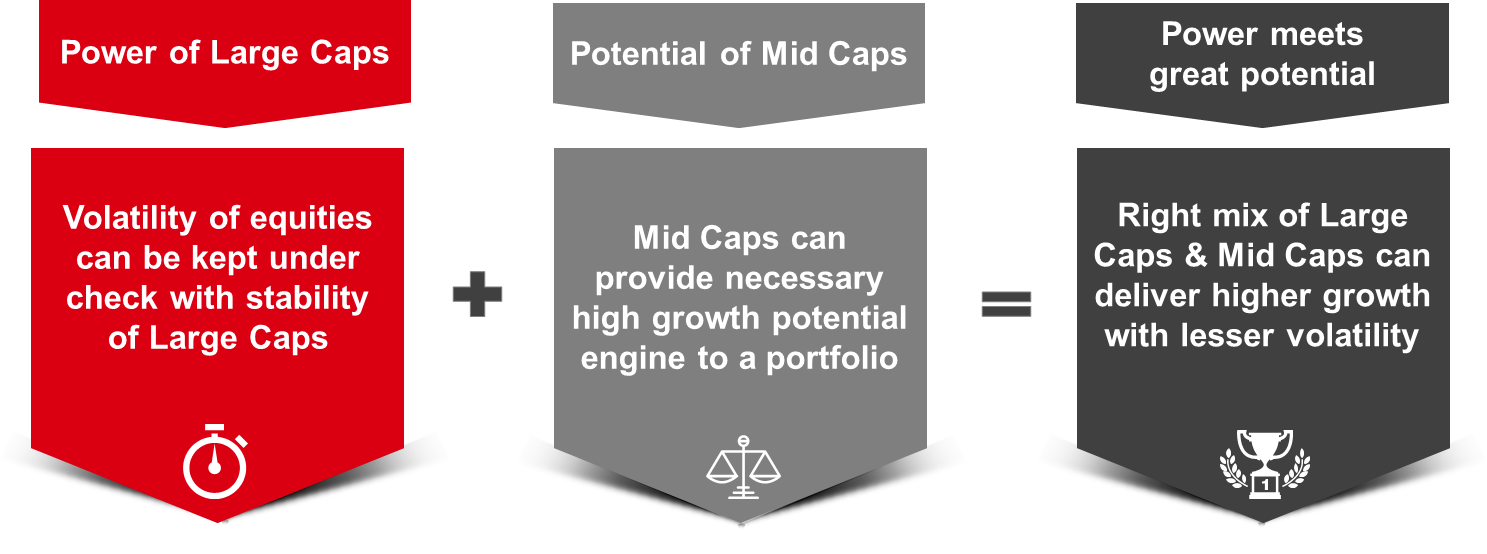

Why HSBC Large and Mid Cap Fund?

- To achieve relatively lower volatility and performance consistency with optimal allocation to large caps

- To increase the possibility of alpha generation and accelerated growth with potential of mid caps

- A top down and bottom up approach will be used to invest in equity and equity related instruments

- True to label fund – The fund will stay true to its objective in keeping with the mandate reposed by the investor whilst investing in the fund

- To create a corpus through generating inflation-adjusted returns to cater to long-term goals

HSBC Large and Mid Cap Fund

Investors understand that their principal

will be at Very High Risk

Large and Mid Cap Fund - An open ended equity scheme investing in both large cap and mid cap stocks.

This product is suitable for investors who are seeking*:

- Long term wealth creation and income

- Investment predominantly in equity and equity related securities of Large and Mid cap companies

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Please note that the above risk-o-meter is as per the product labelling of the Scheme available as on the date of this communication/disclosure. As per SEBI circular dated October 5, 2020 on product labelling (as amended from time to time), risk-o-meter will be calculated on a monthly basis based on the risk value of the scheme portfolio based on the methodology specified by SEBI in the above stated circular. The AMC shall disclose the risk-o-meter along with portfolio disclosure for all their schemes on their respective website and on AMFI website within 10 days from the close of each month. Any change in risk-o-meter shall be communicated by way of Notice cum Addendum and by way of an e-mail or SMS to unitholders of that particular Scheme.

Benchmark: NIFTY Large Midcap 250 TRI

Read more

Begin your journey here

Looking to dream big? Start your journey here.