Gyaan guroovaar

HOW RUPEE COST AVERAGING HELPS

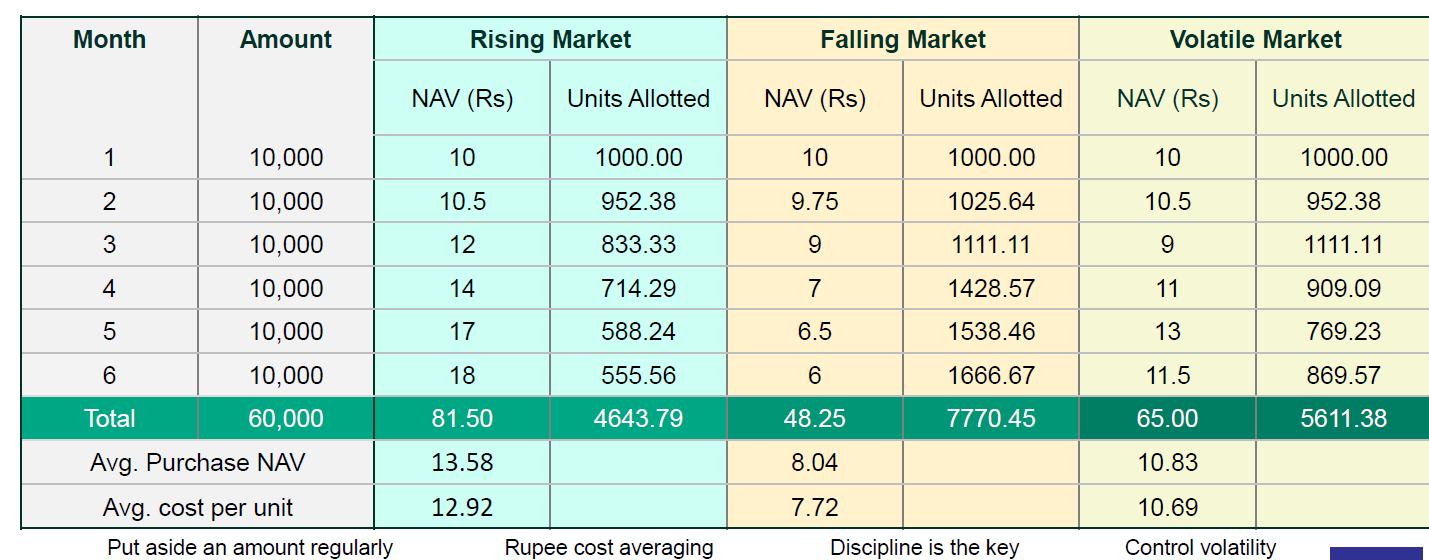

Rupee Cost Averaging is an investment approach wherein one invests fixed sum of money at regular intervals in the securities market. This ensures that one ends up buying more shares (or units of Mutual Fund) when prices are low and less units when prices are high. This investment approach makes prudent sense as equity markets (in which equity mutual funds predominantly invest) go through cycles of volatility over a period of long term like 3 years, 5 years or 10 years. Let us have a look at an example below:

Note: The above example uses assumed figures and is for illustrative purposes only. The same does not indicate or assure any return.

The simplest way to make use of this approach of investing is to invest through “Systematic Investment Plans” (SIP) into mutual funds. Retail investors, who either do not have the expertise to evaluate the equity markets or don’t have the time to actively manage their investments, can easily use SIPs as an investment tool to invest into equity mutual funds.

Source: HSBC Mutual Fund, AMFI

Disclaimer: This document has been prepared by HSBC Asset Management (India) Private Limited for information purposes only and should not be construed as i) an offer or recommendation to buy or sell securities referred to herein or any of the funds of HSBC Mutual Fund; or ii) an investment research or investment advice. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment or investment strategies that may have been discussed or referred herein and should understand that the views regarding future prospects may or may not be realized. This document is intended only for those who access it from within India and approved for distribution in Indian jurisdiction only. Distribution of this document to anyone (including investors, prospective investors or distributors) who are located outside India or foreign nationals residing in India, is strictly prohibited.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

![]() To Transact on WhatsApp – Send us “Hi” on 9326929294 TnC

To Transact on WhatsApp – Send us “Hi” on 9326929294 TnC

![]() For Product updates on WhatsApp – Send us “Hi” on 8879900800

TnC

For Product updates on WhatsApp – Send us “Hi” on 8879900800

TnC

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.