NFO Corner HSBC Consumption Fund

Consumption Fund - An open ended equity scheme following consumption theme

NFO Date: 10 August 2023 - 24 August 2023

Reopening Date: 7 Sep 2023

India is broadly where China was in CY06. Since then, China has seen explosion in consumption spends across categories and we believe that India will follow similar path. India is favorably positioned due to its demographics, formalization of economy, increase women participation in workforce etc. Aspirational Indian are more tech savvy and influenced by social media and ready to spend now than later through use of credit. We are witnessing consumption shifting from unorganized to organized, premium categories and consumer behavior moving towards buying everything anywhere. This should drive strong consumptions spends in the coming decade. HSBC India Consumption fund will aim to capture this strong underlying growth trends in the country.

Investment objective

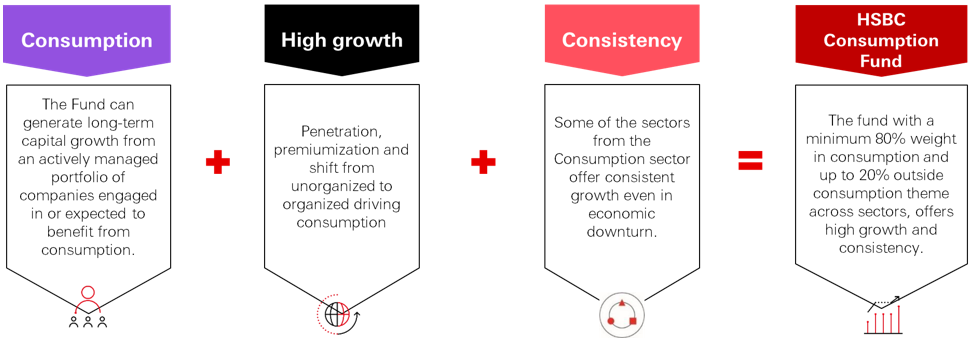

The investment objective of the Fund is to generate long-term capital growth from an actively managed portfolio of equity and equity related securities of companies engaged in or expected to benefit from consumption and consumption related activities. However, there can be no assurance or guarantee that the investment objective of the scheme will be achieved.

![]() To Transact on WhatsApp – Send us “Hi” on 9326929294 TnC

To Transact on WhatsApp – Send us “Hi” on 9326929294 TnC

![]() For Product updates on WhatsApp – Send us “Hi” on 8879900800

TnC

For Product updates on WhatsApp – Send us “Hi” on 8879900800

TnC

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.