Safeguard your goals with debt mutual funds

Debt funds are mutual funds that invest in fixed income instruments, such as corporate and government bonds, corporate debt securities and money market instruments that offer potential capital appreciation. Let’s take a closer look at the important role debt funds play in your investment portfolio and clear some of the myths associated with them.

Myth - Debt funds are only for conservative investors

Reality - Debt funds are a good way for investors to balance their overall investment portfolio. However aggressive an investor’s portfolio, an allocation to debt is always advisable, even if it is miniscule. Debt funds are a great avenue to help an investor diversify the portfolio into a different asset class.

Myth - Investor needs huge amount of money to invest in a debt fund

Reality - Investors can invest in a debt fund with as little as `5,000. If you need to park your cash for just a few months, there are ultra-short duration or liquid funds to look at. Short Duration Funds are for those who would like to invest for a period ranging from one to three years. For periods beyond, there are intermediate and long-term debt funds.

Myth - Debt funds are risk free

Reality - While debt funds are not as volatile as equity funds, they are not without their share of risks. The two prime risks in a debt instrument are:

- Interest rate risk - This refers to a change in the price of a bond due to the change in the prevailing interest rate. The higher the maturity profile of a fund’s portfolio, the more prone it is to interest rate risk.

- Credit Risk - This refers to the fund's credit quality. Credit quality aims to measures the ability of an issuer to repay its debts. Low credit quality of a fund’s portfolio denotes its inclination towards the credit risk.

Myth - Debt funds don’t offer variety

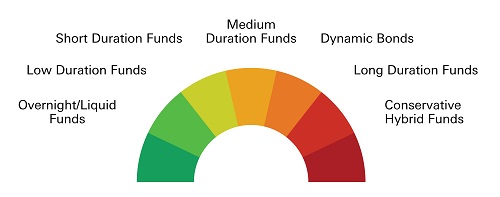

Contrary to the popular belief, debt funds come in various types. Some of them are:

Debt funds give your portfolio the stability it needs and are an important tool in a balanced investment strategy. So, go ahead and safeguard your goals with the help of debt mutual funds.

An Investor Education & Awareness Initiative by HSBC Mutual Fund

Visit https://grp.hsbc/KYC w.r.t. one-time Know Your Customer (KYC) process, complaints redressal process including SEBI SCORES (https://www.scores.gov.in). Investors should only deal with Registered Mutual Funds, to be verified on SEBI website under Intermediaries/Market Infrastructure Institutions (https://www.sebi.gov.in/intermediaries.html). Investors may refer to the section on ‘Investor Education’ on the website of HSBC Mutual Fund for the details on all ‘Investor Education and Awareness Initiatives’ undertaken by HSBC Mutual Fund.

This document is intended only for distribution in Indian jurisdiction. Neither this document nor the units of HSBC Mutual Fund have been registered under Securities law/Regulations in any foreign jurisdiction. The distribution of this document in certain jurisdictions may be unlawful or restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions. If any person chooses to access this document from a jurisdiction other than India, then such person do so at his/her own risk and HSBC and its group companies will not be liable for any breach of local law or regulation that such person commits as a result of doing so.

Mutual fund investments are subject to market risks, read all scheme related documents carefully.

![]() To Transact on WhatsApp – Send us “Hi” on 9326929294 TnC

To Transact on WhatsApp – Send us “Hi” on 9326929294 TnC

![]() For Product updates on WhatsApp – Send us “Hi” on 8879900800

TnC

For Product updates on WhatsApp – Send us “Hi” on 8879900800

TnC

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.