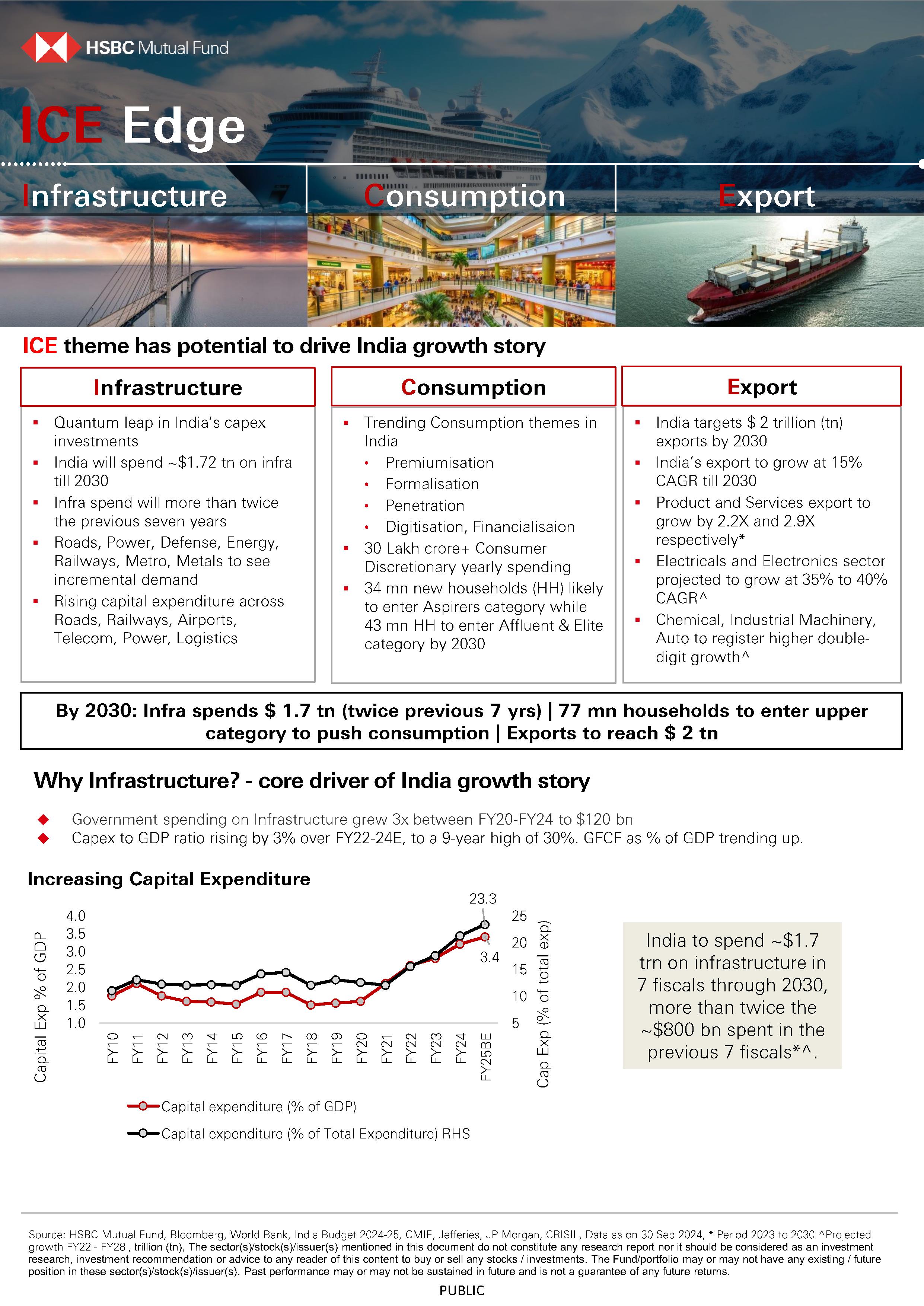

ICE theme has potential to drive India growth story

By 2030: Infra spends $ 1.7 tn (twice previous 7 yrs) | 77 mn households to enter upper category to push consumption | Exports to reach $ 2 tn

SIP

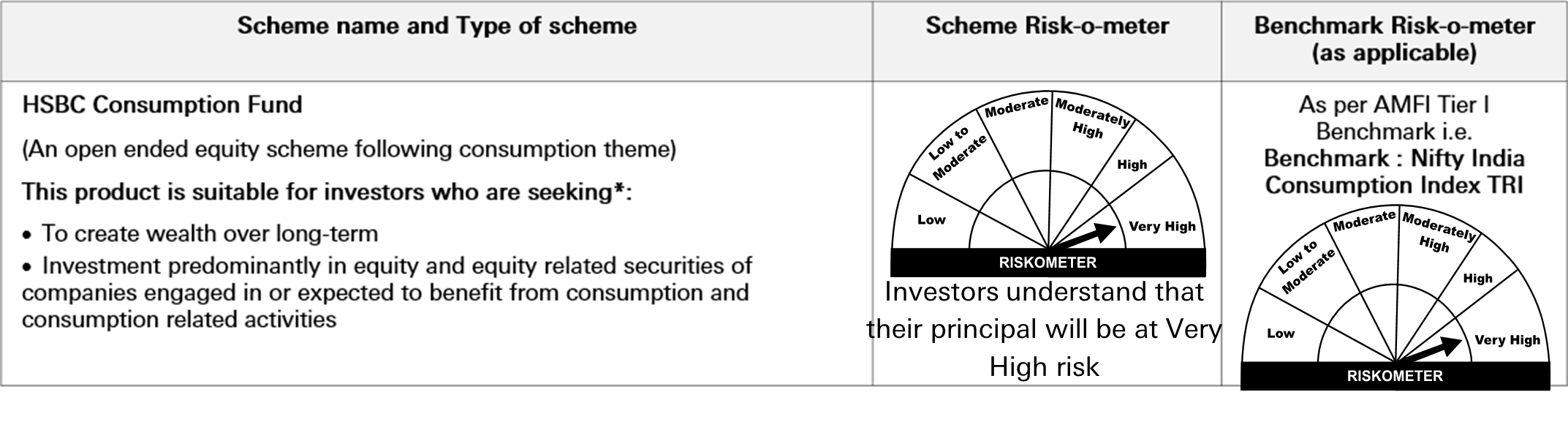

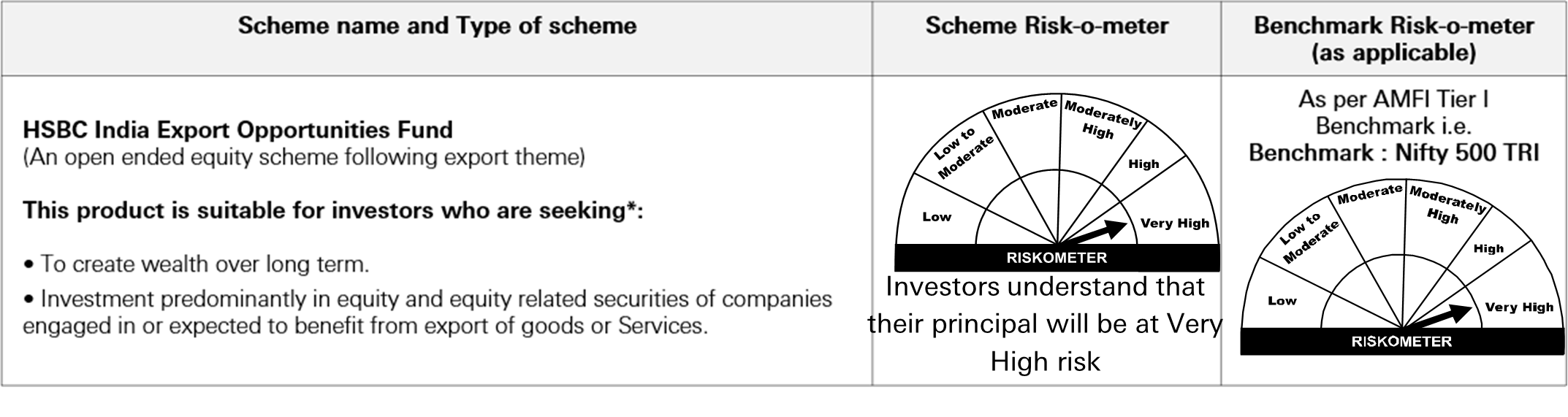

SIPs allow investors to park funds in thematic funds i.e. HSBC Infrastructure Fund, HSBC Consumption Fund and HSBC India Export Opportunities starting with Rs 500 per month, at regular intervals. They help investors benefit from rupee cost averaging and, thus, offset volatility in the equity market.

01

Choose your investment amount

02

Select your investment range

03

Set your starting date

04

Pick mutual fund amount for your SIP

Resources

ICE Edge Booklet |

ICE Age Presentation |

Source: HSBC Mutual Fund, Bloomberg, World Bank, Data as on 30 Sep 2024, * Period 2023 to 2030 ^Projected growth FY22 - FY28 , trillion (tn), The sector(s)/stock(s)/issuer(s) mentioned in this document do not constitute any research report nor it should be considered as an investment research, investment recommendation or advice to any reader of this content to buy or sell any stocks / investments. The Fund/portfolio may or may not have any existing / future position in these sector(s)/stock(s)/issuer(s). Past performance may or may not be sustained in future and is not a guarantee of any future returns.

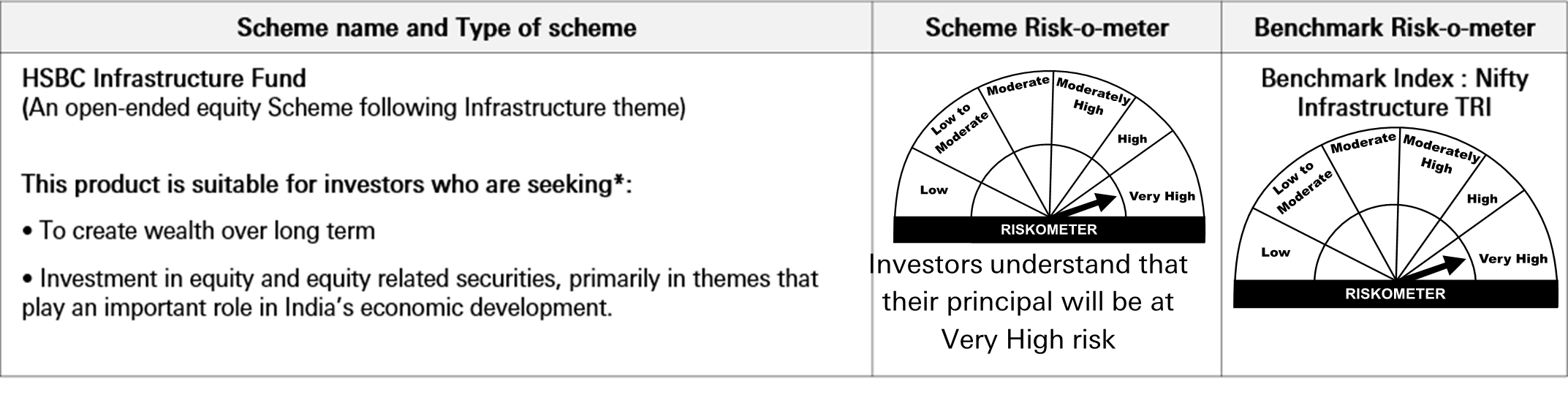

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them. Note on Risk-o-meters: Riskometer is as on 30 September 2024, Any change in risk-o-meter shall be communicated by way of Notice cum Addendum and by way of an e-mail or SMS to unitholders of that particular scheme. Source: HSBC Mutual Fund, data as on 30 September 2024, Past performance may or may not be sustained in the future and is not indicative of future results.

Investors are requested to note that as per SEBI (Mutual Funds) Regulations, 1996 and guidelines issued thereunder, HSBC AMC, its employees and/or empaneled distributors/agents are forbidden from guaranteeing/promising/assuring/predicting any returns or future performances of the schemes of HSBC Mutual Fund. Hence please do not rely upon any such statements/commitments. If you come across any such practices, please register a complaint via email at investor.line@mutualfunds.hsbc.co.in.

This document is intended only for distribution in Indian jurisdiction. Neither this document nor the units of HSBC Mutual Fund have been registered under Securities law/Regulations in any foreign jurisdiction. The distribution of this document in certain jurisdictions may be unlawful or restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions. If any person chooses to access this document from a jurisdiction other than India, then such person do so at his/her own risk and HSBC and its group companies will not be liable for any breach of local law or regulation that such person commits as a result of doing so.

Visit below link and check the latest Riskometer / Product Labels from the “Performance - Equity Hybrid Debt Global Funds” document of the latest month.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Begin your journey here

Looking to dream big? Start your journey here.

Thank you for completing the Form

Your information has been savedApologies for the Inconvenience

An Error occured while saving your information

![]() To Transact on WhatsApp – Send us “Hi” on 9326929294 TnC

To Transact on WhatsApp – Send us “Hi” on 9326929294 TnC

![]() For Product updates on WhatsApp – Send us “Hi” on 8879900800

TnC

For Product updates on WhatsApp – Send us “Hi” on 8879900800

TnC

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.