CEO Speak

The Indian equity markets have been going through a correction phase in the past few months. Global geopolitics at large has been a significant factor affecting the market volatility. However, with the recent budget presented by the Government, consumer spending boost and infrastructure development allocation are positive steps towards driving growth in the domestic economy.

When markets correct, we have seen many investors panic and stop investing fearing short-term losses. Historically, post corrections, markets have proven to be excellent buying opportunities rewarding those who have stayed disciplined

Why investing or staying invested during corrections is smart?

Rupee cost averaging – Your SIPs will buy more units at a lower NAV, thus benefiting you in the long term wealth generation agenda when the markets recover.

Historical trends show market recovery - We have many historical data points in the Indian markets that have shown market recovery post correction. These data points reinforce the fact that corrections are temporary in nature. If you have investable surplus or if you want to do portfolio rebalancing, investing during corrections is a smart strategy.

Power of compounding – Your wealth generation over a period of long term is boosted by the compounding effect. Hence, staying invested during market cycles is beneficial.

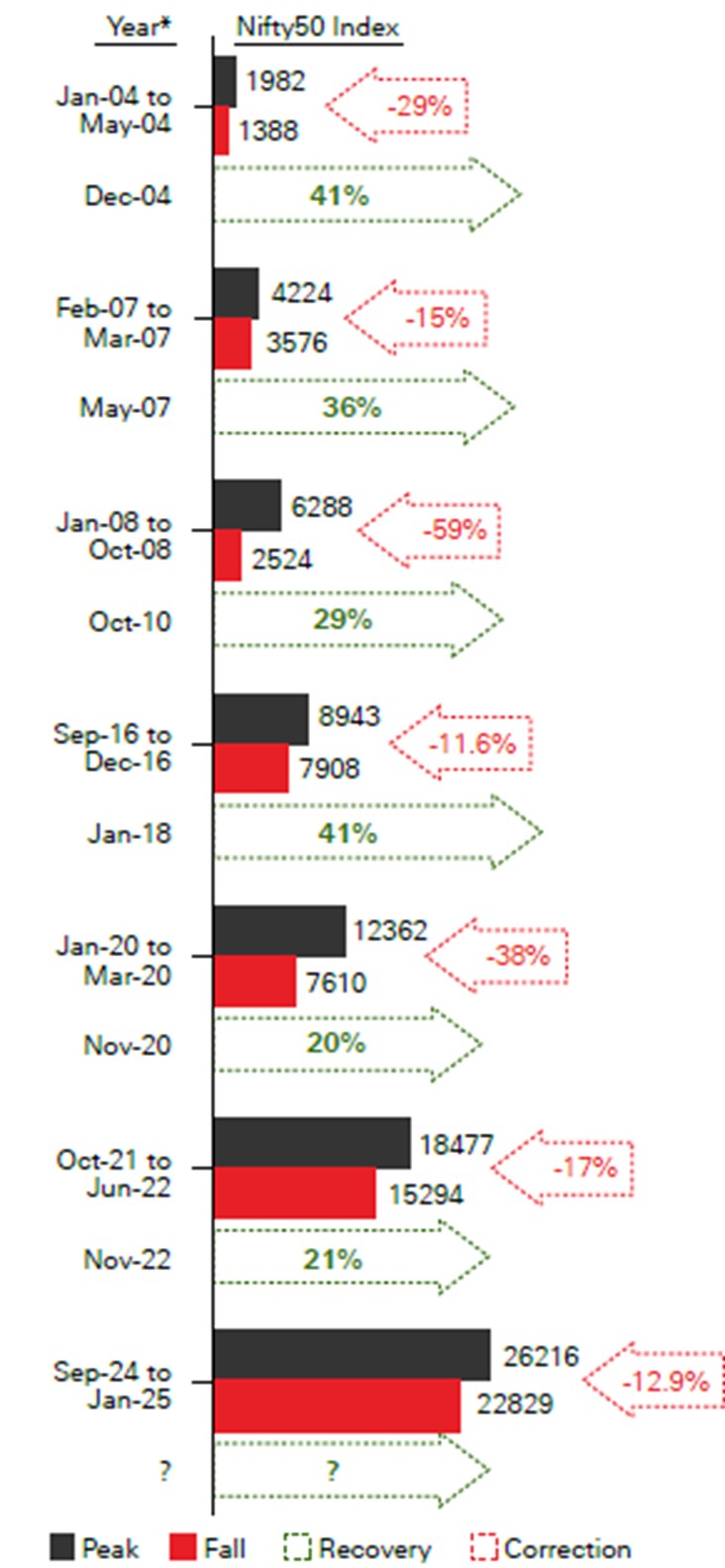

Nifty50 Fall and Recovery

*Note: Some of the market falls and recovery instance are listed above for the period between: 14 Jan‘04 to 17 May‘04, 2 Dec’04, 7 Feb‘07 to 5 Mar‘07, 21 May‘07, 8 Jan‘08 to 27 Oct‘08, 5 Oct‘10, 6 Sep‘16 to 26 Dec‘16, 29 Jan’18, 14 Jan‘20 to 23 Mar‘20,9 Nov‘20, 18 Oct‘21 to 17 Jun‘22, 24 Nov‘22, 26 Sep‘24 to 27 Jan‘25. Correction from the peak point and Recovery from the lowest point of respective period.

Source – Bloomberg, MOSL, HSBC Mutual Fund, Data as on 27 January 2025.

Staying disciplined and persistent in your mutual fund investments:

Continue your SIPs - Investors should stay consistent with their SIP through market cycles. One must remember their financial goal that was long term in nature – market cycles should not affect them. Stopping or pausing SIPs during market corrections will not help your long-term financial goal. Discipline of regular investments plays a crucial role in long term wealth generation.

Review and Rebalance - Use market downturns to review and reassess your portfolios. Pay attention to asset allocation and diversification to mitigate risk and realign to the market opportunities.

Invest with logic and not emotions - Fear during market downturns and greed during a rising market - both lead to irrational investment decisions. Your focus and actions should be persistent on your long-term goals. With abundant information available, your investment decisions should be driven by data-backed insights rather than short term noise.

Corrections are a part of the investment journey in markets. Investors who remain disciplined, continue investing, and stay invested have benefitted over a long period of time. Corrections offer a discounted price that can also be an opportunity if it fits in your financial goals. Mutual funds, when approached with patience, persistence and discipline have proven to be one of the most effective vehicles for long-term financial goals.

Stay invested, Keep investing and Keep growing.

Past performance may or may not be sustained in the future and is not indicative of future results.

Investors are requested to note that as per SEBI (Mutual Funds) Regulations, 1996 and guidelines issued thereunder, HSBC AMC, its employees and/or empanelled distributors/agents are forbidden from guaranteeing/promising/assuring/predicting any returns or future performances of the schemes of HSBC Mutual Fund. Hence please do not rely upon any such statements/commitments. If you come across any such practices, please register a complaint via email at investor.line@mutualfunds.hsbc.co.in.

Views provided above are based on information in public domain and subject to change. Investors are requested to consult their financial advisor for any investment decisions.

Disclaimer: This document has been prepared by HSBC Asset Management (India) Private Limited (HSBC) for information purposes only and should not be construed as i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or ii) an offer to sell or a solicitation or an offer for purchase of any of the funds of HSBC Mutual Fund; or iii) an investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment or investment strategies that may have been discussed or referred herein and should understand that the views regarding future prospects may or may not be realized. In no event shall HSBC Mutual Fund/HSBC Asset management (India) Private Limited and / or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information / opinion herein.

This document is intended only for those who access it from within India and approved for distribution in Indian jurisdiction only. Distribution of this document to anyone (including investors, prospective investors or distributors) who are located outside India or foreign nationals residing in India, is strictly prohibited. Neither this document nor the units of HSBC Mutual Fund have been registered under Securities law/Regulations in any foreign jurisdiction. The distribution of this document in certain jurisdictions may be unlawful or restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions. If any person chooses to access this document from a jurisdiction other than India, then such person do so at his/her own risk and HSBC and its group companies will not be liable for any breach of local law or regulation that such person commits as a result of doing so.

© Copyright. HSBC Asset Management (India) Private Limited 2024, ALL RIGHTS RESERVED. All third party trademarks (including logos and icons) remain the property of their respective owners. Use of it does not imply any affiliation with or endorsement by them.

HSBC Mutual Fund, 9-11th Floor, NESCO - IT Park Bldg. 3, Nesco Complex, Western Express Highway, Goregaon East, Mumbai 400063. Maharashtra.

GST - 27AABCH0007N1ZS | Website: www.assetmanagement.hsbc.co/in

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

CL 2390

![]() To Transact on WhatsApp – Send us “Hi” on 9326929294 TnC

To Transact on WhatsApp – Send us “Hi” on 9326929294 TnC

![]() For Product updates on WhatsApp – Send us “Hi” on 8879900800

TnC

For Product updates on WhatsApp – Send us “Hi” on 8879900800

TnC

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.