HSBC Corporate Bond Fund

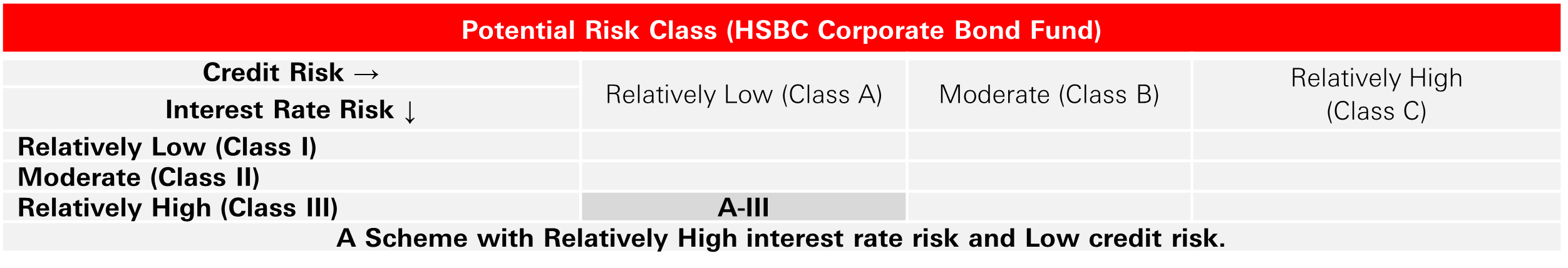

Corporate Bond Fund - An open-ended debt scheme predominantly investing in AA+ and above rated corporate bonds. A relatively high interest rate risk and relatively low credit risk.

(Formerly known as L&T Triple Ace Bond Fund)

Investment objective

To generate regular return by investing predominantly in AA+ and above rated debt and money market instruments. There is no assurance that the objective of the Scheme will be realised and the Scheme does not assure or guarantee any returns.

Our philosophy

- We deploy a balanced approach to credit and risk management

- Transparency in investment methodology

- Active investment opportunity supported by proprietary credit research

Our process

Proprietary research drives security selection:

- Balanced approach for security selection to achieve optimal risk adjusted returns

- Balanced approach in managing risk – well managed issuer concentration

- Benefits from global investment network and research sharing platform

Why HSBC Corporate Bond Fund?

- The scheme would invest predominantly in AA+ and above rated corporate bond instruments with an aim to generate returns matching the investment objective

- The fund’s portfolio would carry relatively low credit risk by virtue of its focus on investing predominantly in AA+ and above rated instruments

- The overall portfolio structuring would aim at controlling risk at moderate level

- Security specific risk will be minimised by investing only in those companies that have been thoroughly researched in-house

- True to label fund – The fund will stay true to its objective in keeping with the mandate reposed by the investor whilst investing in the fund

- To create a corpus through generating inflation-adjusted returns

| Scheme name and Type of scheme | ||

|---|---|---|

|

HSBC Corporate Bond Fund (An open ended debt scheme predominantly investing in AA+ and above rated corporate bonds. A relatively high interest rate risk and relatively low credit risk) This product is suitable for investors who are seeking*:

|

|

|

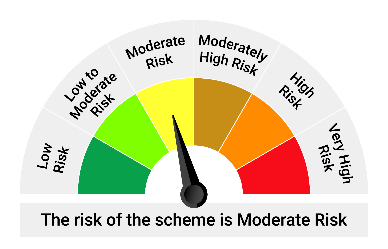

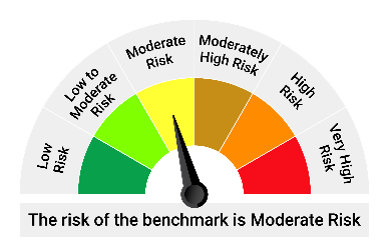

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them. Note on Risk-o-meters: The risk-o-meter is as per the product labelling of the Scheme available as on the date of this communication/disclosure Any change in risk-o-meter shall be communicated by way of Notice cum Addendum and by way of an e-mail or SMS to unitholders of that particular scheme.

Visit this link and check the latest Riskometer / Product Labels in the “Performance - Equity Hybrid Debt Global Funds” document of the latest month. Past performance may or may not be sustained in the future and is not indicative of future results.

Potential Risk Class (‘PRC’) matrix indicates the maximum interest rate risk (measured by Macaulay Duration of the scheme) and maximum credit risk (measured by Credit Risk Value of the scheme) the fund manager can take in the scheme. PRC matrix classification is done in accordance with and subject to the methodology/guidelines prescribed by SEBI to help investors take informed decision based on the maximum interest rate risk and maximum credit risk the fund manager can take in the scheme, as depicted in the PRC matrix.

Investors are requested to note that as per SEBI (Mutual Funds) Regulations, 1996 and guidelines issued thereunder, HSBC AMC, its employees and/or empaneled distributors/agents are forbidden from guaranteeing/promising/assuring/predicting any returns or future performances of the schemes of HSBC Mutual Fund. Hence please do not rely upon any such statements/commitments. If you come across any such practices, please register a complaint via email at investor.line@mutualfunds.hsbc.co.in.

This document/content is intended only for distribution in Indian jurisdiction. Neither this document nor the units of HSBC Mutual Fund have been registered under Securities law/Regulations in any foreign jurisdiction. The distribution of this document in certain jurisdictions may be unlawful or restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions. If any person chooses to access this document from a jurisdiction other than India, then such person do so at his/her own risk and HSBC and its group companies will not be liable for any breach of local law or regulation that such person commits as a result of doing so.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Read more

![]() To Transact on WhatsApp – Send us “Hi” on 9326929294 TnC

To Transact on WhatsApp – Send us “Hi” on 9326929294 TnC

![]() For Product updates on WhatsApp – Send us “Hi” on 8879900800

TnC

For Product updates on WhatsApp – Send us “Hi” on 8879900800

TnC

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Begin your journey here

Looking to dream big? Start your journey here.