Passive investing has been at the heart of our business strategy since 1988.

With this strong heritage we have strengthened the ETF team to develop our capability to react better to the market and client demand.

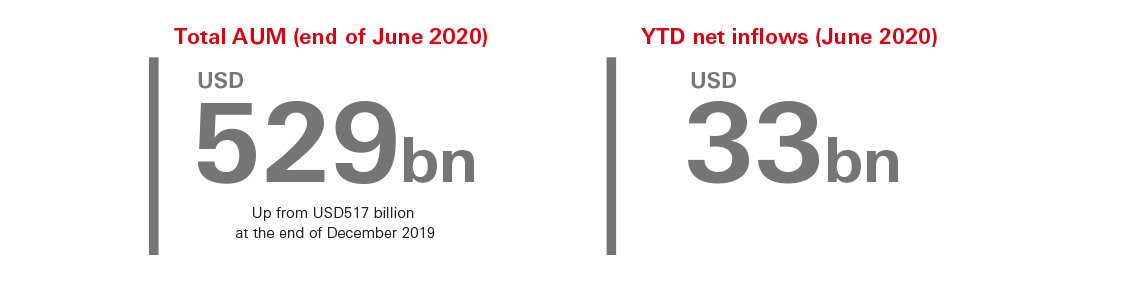

First Half 2020 Business Update

The COVID-19 pandemic and lockdown have changed the way we operate. Economies have been shocked in an unprecedented way, while government measures to suppress the virus have had profound implications for investment decision making. Despite downside risks, our core scenario remains that we will see a ‘swoosh’ shape to the global recovery – a sharp rebound in the near-term followed by a more gradual growth trajectory. As the economic restart progresses, macro data is improving. The pace of recovery remains uncertain, especially beyond Q3, and there are challenges around the quantity and the quality of growth.

The crisis has also accelerated a permanent shift in working practices and consumer behaviours. Like other global businesses, we have had to implement and develop our business continuity plans to ensure our operations continue to run smoothly and our client servicing remains uninterrupted. For our employees across the globe, we continue to promote flexible working, supported by our secure technology infrastructure.

Financial

*Alternatives assets include USD4 billion from committed capital ('dry powder').

**Others refer to the assets of Hang Seng Bank, in which HSBC has a majority holding, and of HSBC Jintrust Fund Management, a joint venture between HSBC Global Asset Management and Shanxi Trust Corporation Limited.

Source: HSBC Global Asset Management as at 30 June 2020. Any differences are due to rounding.

Our strategy

Our vision is to become a core solutions and specialist Emerging Markets, Asia and Alternatives focused asset manager with client centricity, investment excellence and sustainable investing being the key proponents of our strategy. And here’s where we have arrived so far:

Established a market competitive, client-centric operational model to deliver high quality pre-sales, sales and post-sales service to our clients. By changing our distribution model to operate with a global approach with the Institutional and Wholesale client businesses, we can better take responsibility for all aspects of client coverage

Established a market competitive, client-centric operational model to deliver high quality pre-sales, sales and post-sales service to our clients. By changing our distribution model to operate with a global approach with the Institutional and Wholesale client businesses, we can better take responsibility for all aspects of client coverage

Enhanced our capabilities while expanding the range of instruments in which we invest, to achieve investment excellence and innovation. We have taken steps to enable a ‘multi-process strategy’ within investment platforms, allowing us to be more performance-focused and outcome-orientated

Enhanced our capabilities while expanding the range of instruments in which we invest, to achieve investment excellence and innovation. We have taken steps to enable a ‘multi-process strategy’ within investment platforms, allowing us to be more performance-focused and outcome-orientated

Continued to incorporate environmental, social and governance (ESG) factors in our investment process and deliver innovative solutions to generate sustainable, long-term returns for our investors to meet their sustainable investment objectives and support the sustainable development goals

Continued to incorporate environmental, social and governance (ESG) factors in our investment process and deliver innovative solutions to generate sustainable, long-term returns for our investors to meet their sustainable investment objectives and support the sustainable development goals

Created a single global operating model called ‘Global Markets’ (US, UK, France, Germany and Hong Kong) to provide a consistent service for our multi geography clients

Created a single global operating model called ‘Global Markets’ (US, UK, France, Germany and Hong Kong) to provide a consistent service for our multi geography clients

Further developed our offshore ‘Centre of Excellence’ in Bangalore

Further developed our offshore ‘Centre of Excellence’ in Bangalore

Launched our LinkedIn channel as an additional medium to communicate with our clients

Launched our LinkedIn channel as an additional medium to communicate with our clients

Passive investing has been at the heart of our business strategy since 1988.

With this strong heritage we have strengthened the ETF team to develop our capability to react better to the market and client demand.

We continue to bring the world to Asia and Asia to the rest of the world.

We accelerated domestic wealth growth via our Joint Venture in mainland China and increased retail flows through product innovation, partnering with third party distributors and online platforms, and strengthening our cross-border capabilities.

In a world of uncertainty, low interest rates and high asset correlation, investors are increasingly looking at new areas for yield enhancement and diversification.

Reinforced by our strong client base, our alternative assets under management reached approximately USD32 billion1 as at end June 2020.

As part of our ambition to grow our investment capabilities in alternatives, HSBC Bank’s Principal Investments and Alternative Investments Group is merging with our Alternatives Private Markets business (subject to completion of relevant due diligence and approval from regulators). This will position us as one of the largest investors in private markets funds globally, enabling us to rapidly develop investment solutions to serve our clients.

We have a competitive liquidity franchise and will continue to build leadership in liquidity. As at end June 2020, we have recorded a 20 per cent increase in liquidity AUM year-to-date.

Strategic priorities

We will continue to build on the momentum that has been created by our strategic business objectives, and prioritise the growth initiatives which we believe will underpin our success in the future. This includes building our direct investment capabilities in alternatives, growing our Asia and China franchises, and providing investors with both active and passive sustainable investment solutions.

We have the full support of the HSBC Group to enable us to build a business that is stronger, more client centric and ultimately more successful. As we continue to monitor the developments relating to the pandemic, our priority remains the wellbeing of our clients and employees and ensuring that we meet your evolving investment needs.

1 Alternatives assets include USD4 billion from committed capital (‘“dry powder’”). Source: HSBC Global Asset Management as at 30 June 2020. Any differences are due to rounding.

2 Award issued by MoneyAge, 23 April 2020.

3 Award issued by MoneyAge, 23 April 2020.

4 Award issued by HFM, 8 July 2020, based on product performance and qualitative factors as at March 2020.

This page is prepared for general information purposes only and does not have any regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive it. Any views and opinions expressed are subject to change without notice. This document does not constitute an offering document and should not be construed as a recommendation, an offer to sell or the solicitation of an offer to purchase or subscribe to any investment. References to ‘we’, ‘us’ and ‘our’ are references to HSBC Global Asset Management.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully

Begin your journey here

Looking to dream big? Start your journey here.