The Macro Sphere

Monetary Policy – How far have we come and the way ahead

History might not repeat itself, but it often rhymes. In this note, we attempt to identify if the current policy easing phase rhymes with any of the past rate easing cycles.

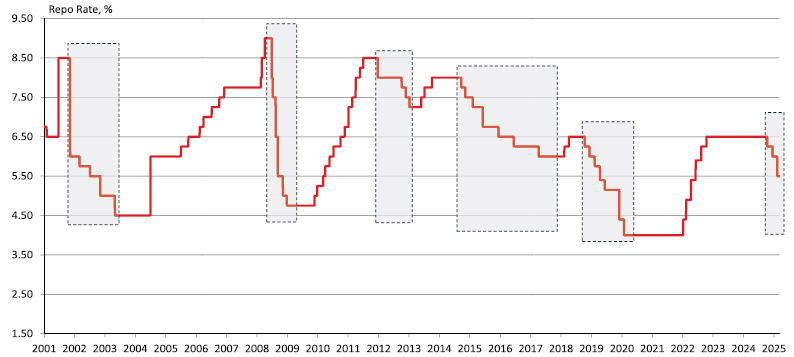

Repo Rate trend: The past easing cycles, boxed

Source – RBI, RBI Database, CMIE, Bloomberg, HSBC Research AMC, Fixed Income.

In this note we look at the rate cycles which were undertaken in the post-FIT regime – Flexible Inflation Targeting (FIT) framework and the year when the Monetary Policy Committee was instituted. Thus, in the backdrop of the structural changes as well as for the purposes of relevance to the current easing cycle period, we will focus on the rate easing cycles for the period 2016-2025 so far.

Prior to the current rate easing cycle, there are two easing cycles over this period viz. the 2015-17 cycle and the 2019 cycle (not considering the covid induced easing from Mar’20 given its exceptional backdrop).

Our key message:

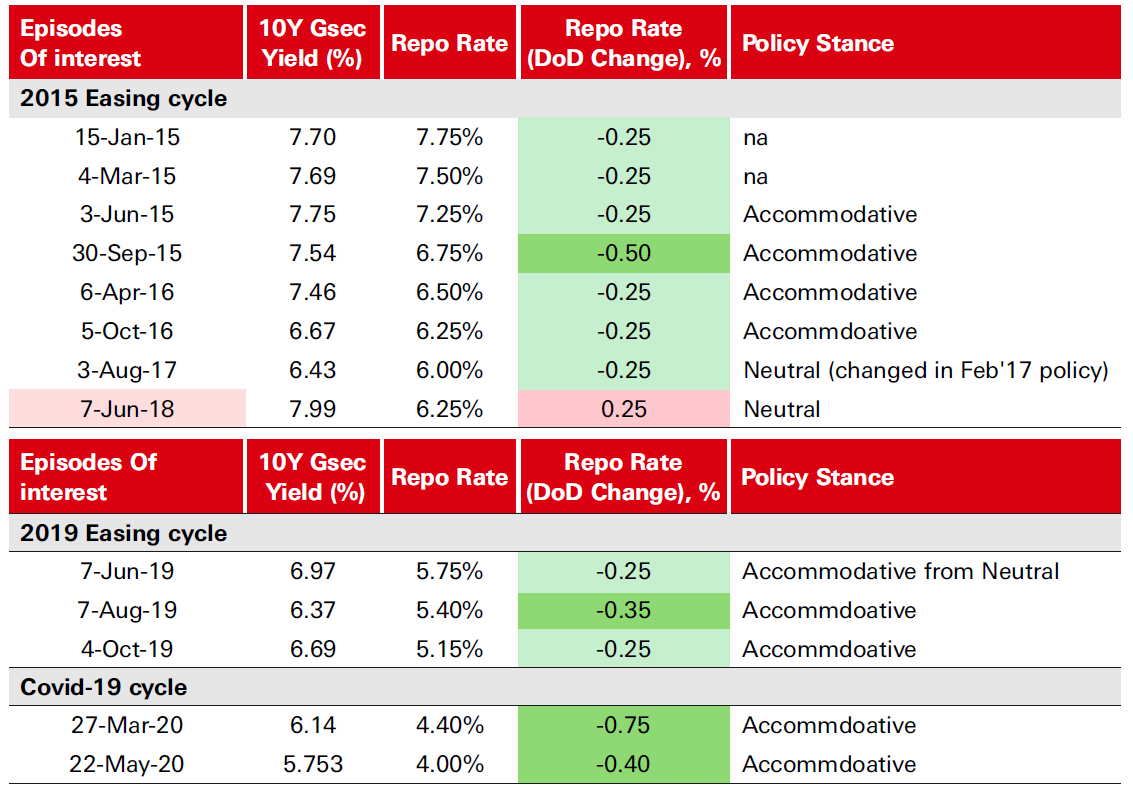

Of the 2015-17 and 2019 easing cycles, the 2019 cycle appears more relatable more so because towards the end of 2017s accommodative cycle, the economy saw demonetization (DeMon), the rollout of GST, global uncertainty, higher crude prices and in totality upside risks to domestic inflation outlook. Consequently, in 9-months of the last cut, the RBI-MPC hiked policy the rates by 25bps with the stance being ‘neutral’.

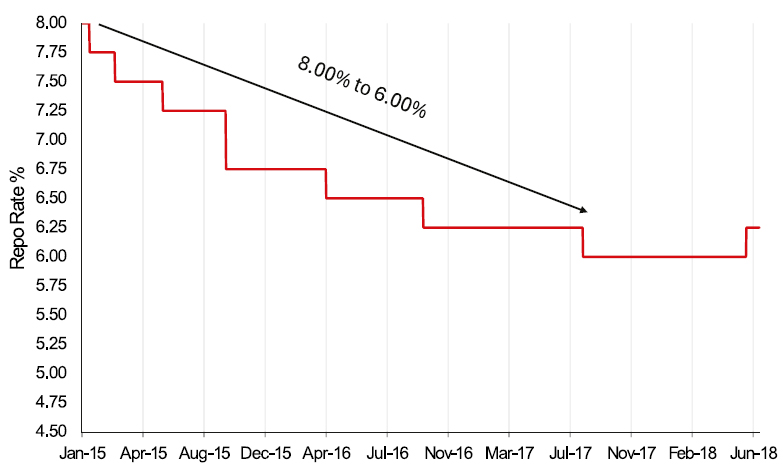

Repo Rate in the 2015-easing cycle

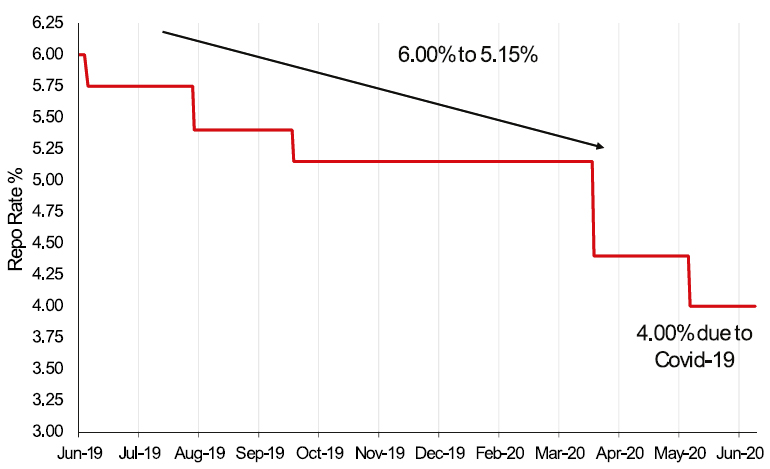

Repo Rate in the 2019-easing cycle

Source – RBI, RBI Database, CMIE, Bloomberg, HSBC Research AMC, Fixed Income.

Note: *DoD = Day-to-Day change; per cent change in yield if minus implies a fall in yield. 10 Yield levels is Bloomberg Ticker

Colouring: where Red indicates a Hike; Green is 0.25 per cent Cut, Dark green is > 0.25 per cent Cut.

Liquidity management approach is dynamic in each cycle, but largely tracking the policy rate.

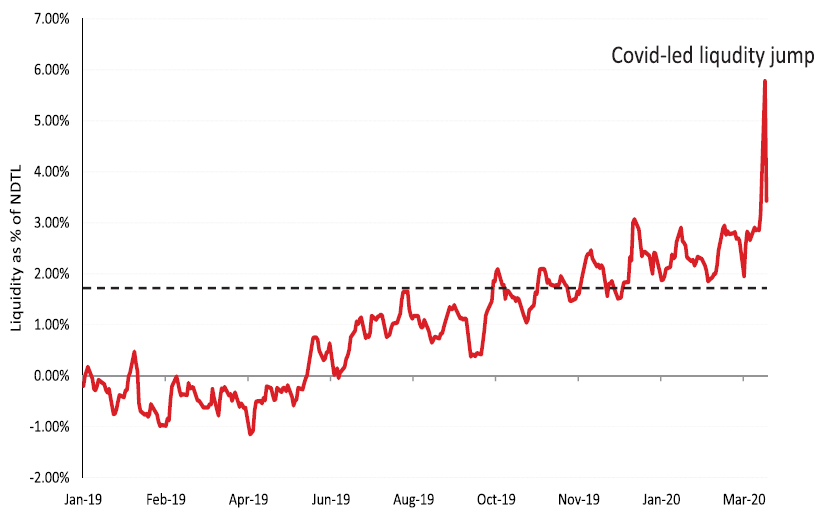

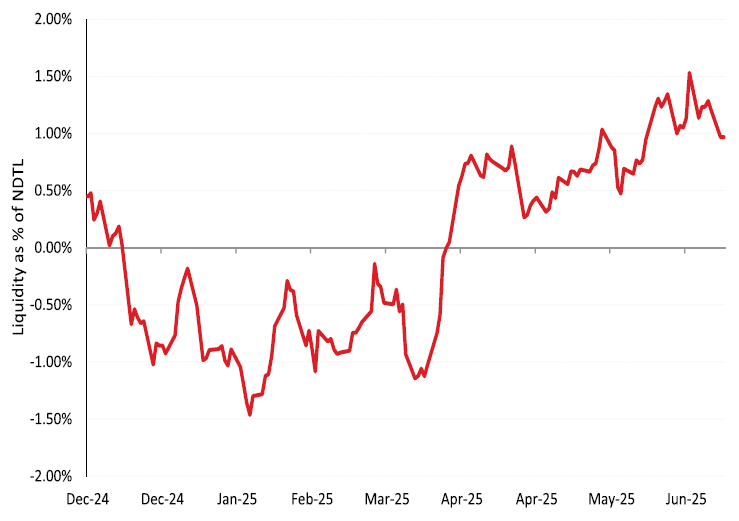

In 2019, the RBI took steps to infuse liquidity and kept system liquidity in the surplus ranging 1.0-2.0 per cent of NDTL (Liquidity charts below compare the 2025 and 2019 cycles). The RBI conducted OMO Purchases to the tune of INR 3 lakh crore in 2019.

The 2025 easing cycle rhymes with 2019 cycle in terms of surprise rate actions, liquidity measures and 10Y yield ebbing in anticipation of limited space for further policy action, incrementally.

Since, December 2024, the RBI has acted to infuse liquidity and also indicated that it would keep system surplus around ~1.0-1.5 per cent of NDTL; the aggressive steps as well as the June announcement of the 100bps CRR cut starting from Sept-Dec 2025 suggests that the liquidity surplus is here to stay. Thus, it increases the conviction of focusing on liquidity driven influence for rates market vs incremental rate cuts. The shift to ‘neutral’ stance at the June policy as well as the MPC minutes do indicate that the focus is on liquidity-led transmission after having frontloaded the rate cuts.

Liquidity Conditions mirroring the 2019 phase

Liquidity during 2019 to March 2020

Liquidity steps from Dec-2024 to Jun 2025

Source – RBI, RBI Database, CMIE, Bloomberg, HSBC Research AMC, Fixed Income.

*Data as of 24-Jun-25

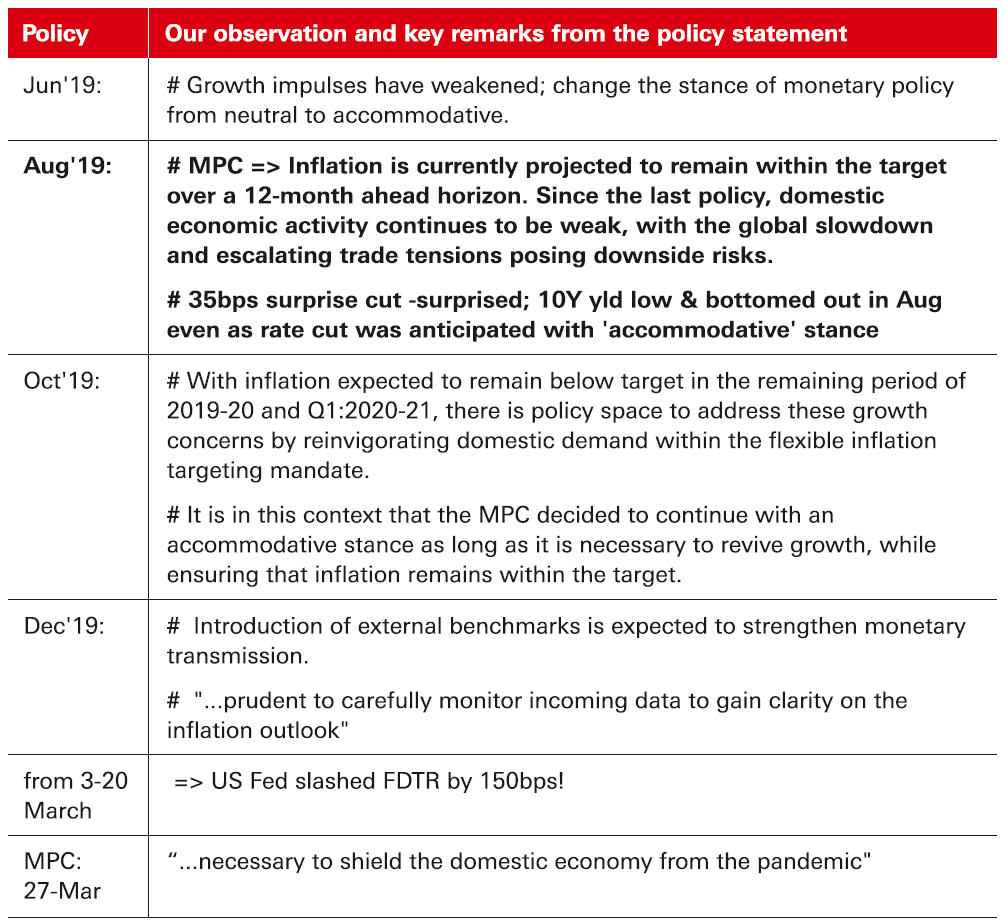

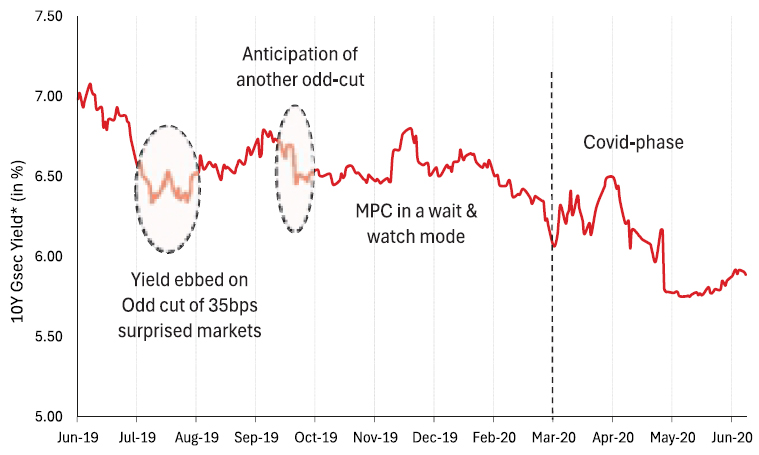

A notable observation is that in Aug’19, the Governor announced an odd cut of 35bps and despite accommodative stance as markets remained surprised and anticipation of whether next cut would come through or it’s a pause or whether it would be 15bps cut or a 40bps did distort rate cut expectations.

Source: RBI, RBI Database, CMIE, Bloomberg, HSBC Research AMC, Fixed Income

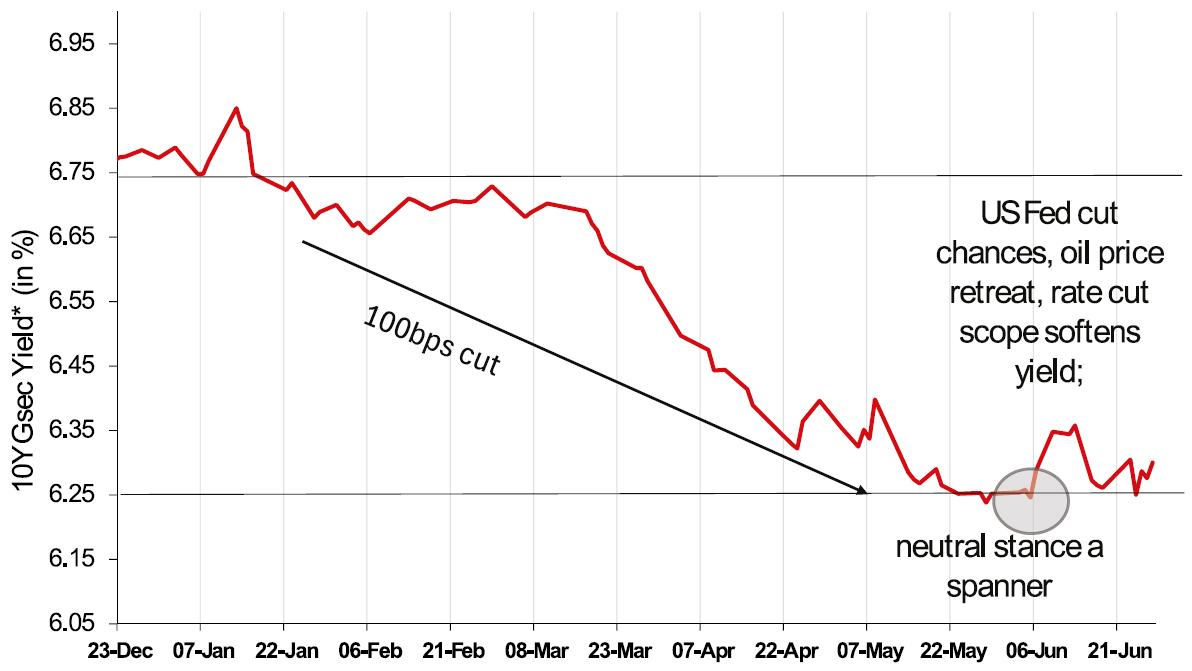

The 50bps surprise cut in Jun’25 is similar to the Aug’19 policy of 35bps, when the 10-year G-Sec yield created the cycle low of 6.33 per cent on the back of the unexpectedly outsized 35bps Repo rate cut. Similarly, the 10Y G-Sec yield touched an intra-day low of 6.10 per cent on 6th Jun 25, which probably will turn out to be the cycle low. The 10Y G-Sec yield has gradually moved higher after the front-loaded 50bps Repo Rate cut which on the back of a change to neutral stance took market participants off-guard, raising speculation around the end of policy easing. The remark from the policy statement, “…monetary policy will be left with very limited space to support growth” soured investor sentiments. This coupled with the CRR cut announcement reduced the scope of OMO Purchases further weighed on market sentiments.

Reaction in markets post the MPC outcome: 10Y yield bottomed

Note: *10Y Yield from Bloomberg, Data from December 2024 to June 2025

Source – RBI, RBI Database, CMIE, Bloomberg, HSBC Research AMC, Fixed Income.

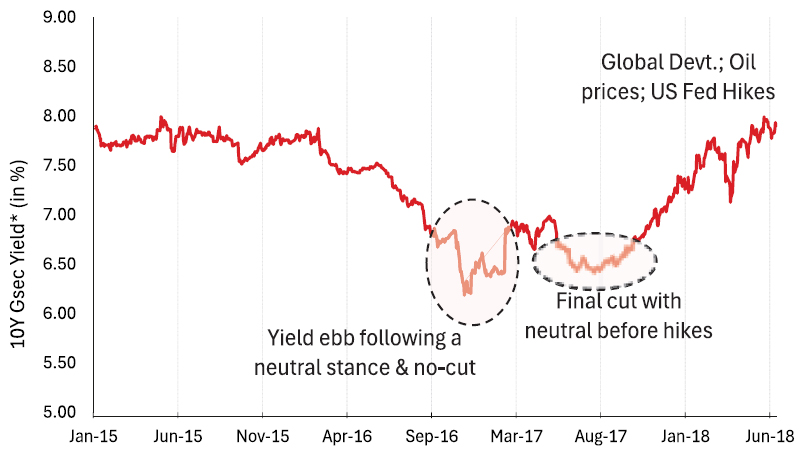

Apart from 2019, similarities are also observed in the latter part of the easing cycle of 2015-17; especially for the 10Y sovereign yield which was marred by sudden change in policy easing expectations following the demonetization phase – where 10Y yield ebbed in February 2017 when the policy stance was changed to neutral, and the final cut was delivered in August 2017 owing to growth concerns. The global developments, oil price rise, uptick in domestic inflation resulted in a change in policy course in June 2018 – but even during the easing phase of 2016-to-2017, yields bottomed out with the penultimate rate cut of the cycle, in anticipation of changes in policy posturing.

10Y G-Sec movement during 2015 easing cycle

10Y G-Sec movement during the 2019 easing cycle

Source – RBI, RBI Database, CMIE, Bloomberg, HSBC Research AMC, Fixed Income.

The statistical and data analysis as well as drawing inference from the June RBI-MPC Policy and its Minutes, we believe that the scope for deeper incremental rate cuts remains limited, absence of major shocks.

Incrementally, whether we could see 25-50bps rate cuts come through by end-2025 or whether there would be a long pause is likely to hinge on global developments as domestic growth inflation is seen play out as per MPC’s assessment – with slight downward bias to inflation. However, we think a far weaker growth outlook might trigger more action by RBI and the MPC when looking at domestic data. For now, it is more certain that the August policy would be a hold with a data-driven approach.

A material change in global growth outlook, US growth and trade tariff dynamics, the US Fed monetary policy approach would require close monitoring to assess MPC’s next policy action.

All-in-all, into this current cycle, the macros and markets have evolved and developed especially with the formalization of the inflation targeting framework and the institutionalization of the monetary policy committee. On the fiscal side, there has been continued progress on fiscal consolidation (post pandemic shock) with improved expenditure mix. On the markets front, we have seen the fixed income markets develop especially with it getting more legs with Bond inclusion in Global Bond Indices in the EM category further show how far we have come. All these factors evince that the frameworks, the policies, the committee have all evolved with the markets far more matured too.

When compared to say the 2015-17 cycle, by the end of this easing cycle, the macro dynamics changed with inflation accelerating, oil prices rising which in turn led to a shift in the MPC policy. Just before the policy turn, the 10Y yield ebbed and started to edge higher.

In entirety, currently, the dynamics are different from the period 2015/2019 easing cycles. With the expectations of CPI inflation hovering around its medium-term target of 4.0 per cent and economic growth likely to settle in the 6.0- 7.0 per cent YoY for next couple of years. In this milieu, coupled with an imports cover of ~13-months, absence of any global setbacks, suggest that we may not see a sudden shift or reversal in the monetary policy approach at least for the next four-five quarters, even with a neutral stance. In this context, we continue to see the 10Y yield remain fairly range-bound and expect system liquidity to be a key influencing factor in the near-term.

Past performance may or may not be sustained in future and is not a guarantee of any future returns.

Source – RBI, RBI Database, CMIE, Bloomberg, HSBC Research AMC, Fixed Income. Data as on end-June 2025 or latest available.

Note: Views provided above are based on information in public domain and subject to change. Investors are requested to consult their financial advisor for any investment decisions.

Disclaimer: This document has been prepared by HSBC Asset Management (India) Private Limited (HSBC) for information purposes only and should not be construed as i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or ii) an offer to sell or a solicitation or an offer for purchase of any of the funds of HSBC Mutual Fund; or iii) an investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment or investment strategies that may have been discussed or referred herein and should understand that the views regarding future prospects may or may not be realized. In no event shall HSBC Mutual Fund/HSBC Asset management (India) Private Limited and / or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information / opinion herein. This document is intended only for those who access it from within India and approved for distribution in Indian jurisdiction only. Distribution of this document to anyone (including investors, prospective investors or distributors) who are located outside India or foreign nationals residing in India, is strictly prohibited. Neither this document nor the units of HSBC Mutual Fund have been registered under Securities law/Regulations in any foreign jurisdiction. The distribution of this document in certain jurisdictions may be unlawful or restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions. If any person chooses to access this document from a jurisdiction other than India, then such person do so at his/her own risk and HSBC and its group companies will not be liable for any breach of local law or regulation that such person commits as a result of doing so.

Document intended for distribution in Indian jurisdiction only and not for outside India or to NRIs. HSBC MF will not be liable for any breach if accessed by anyone outside India. For more details, click here / refer website.

© Copyright. HSBC Asset Management (India) Private Limited 2025, ALL RIGHTS RESERVED.

HSBC Mutual Fund, 9-11th Floor, NESCO - IT Park Bldg. 3, Nesco Complex, Western Express Highway, Goregaon East, Mumbai 400063. Maharashtra.

GST - 27AABCH0007N1ZS | Website: www.assetmanagement.hsbc.co.in.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.