GST 2.0 Reforms - Sectoral Impact - Sept 2025

Consumption boost amidst continued reforms

2-slab structure to ease compliance and working capital requirement

GST council approves new structure

GST Council confirmed discontinuing 12 per cent and 28 per cent slabs, leaving only two primary rates of 5 per cent and 18 per cent, plus 40 per cent for sin/demerit goods. These measures will get effective from September 22 (first day of Navratri), which is the beginning of the festive season. It will be the last day for compensation cess on all products except tobacco.

Clean structure with less complexities

~75 per cent of total taxes are likely to be collected at 18 per cent rate now. Over the past 7-8 years, GST effective rate (given exemptions/ zero-rated goods) falls to around 10 per cent (from almost 15 per cent). Several inverted duty structure issues have been corrected which should help in better working capital for smaller firms.

Fiscal stimulus to boost consumption

Based on FY24 consumption data, government estimates ~Rs 930bn of revenue loss (~1.8tn for full-year; 0.5 per cent of GDP), with net impact of Rs 480bn (~1tn for full-year) post considering benefit from increase in rates for certain products from 28 per cent to 40 per cent The benefit of this cut should start accruing over coming months.

Source: Government of India, GST RNR Committee, Axis Bank Research estimates, HSBC Mutual Fund

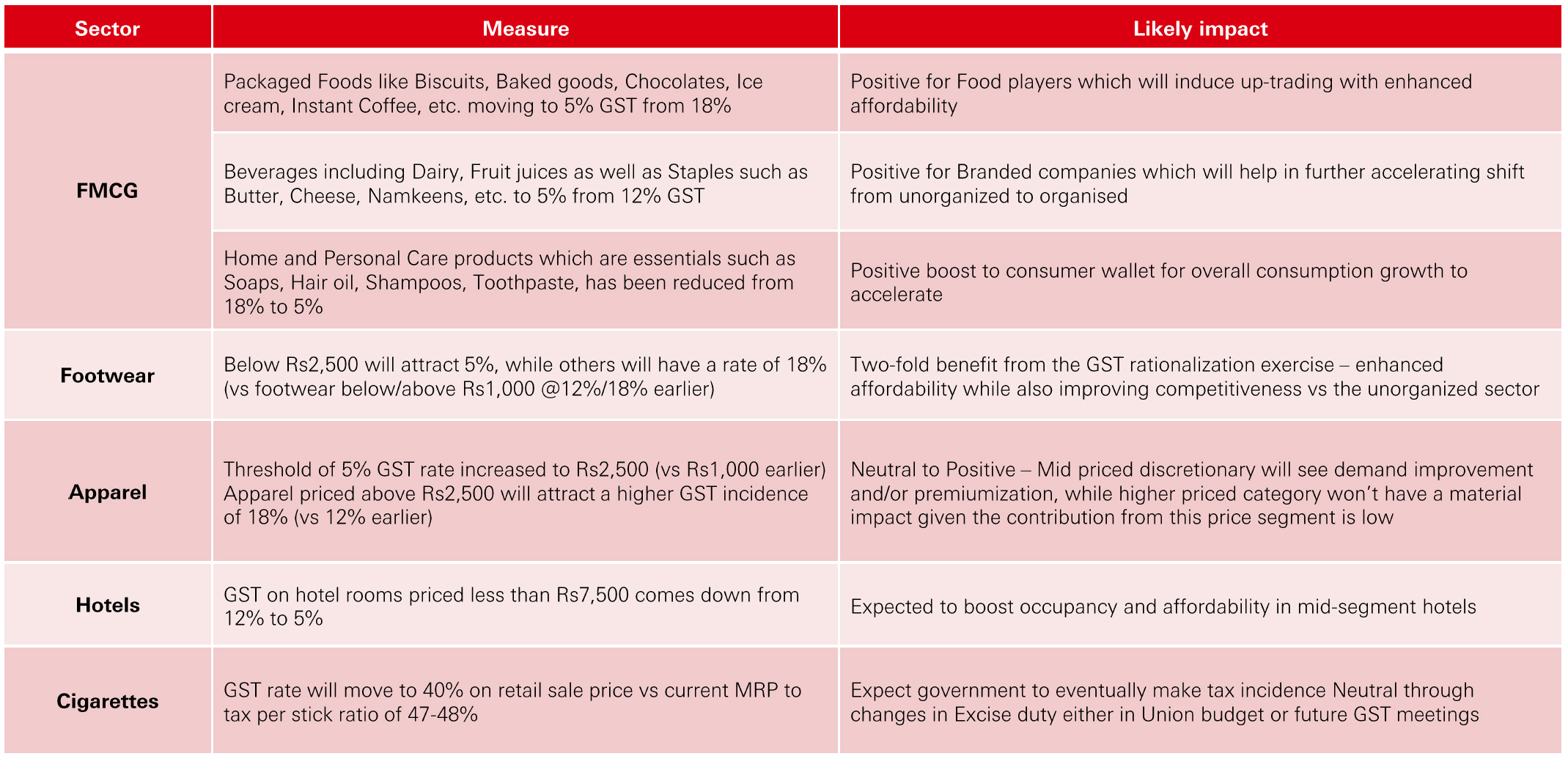

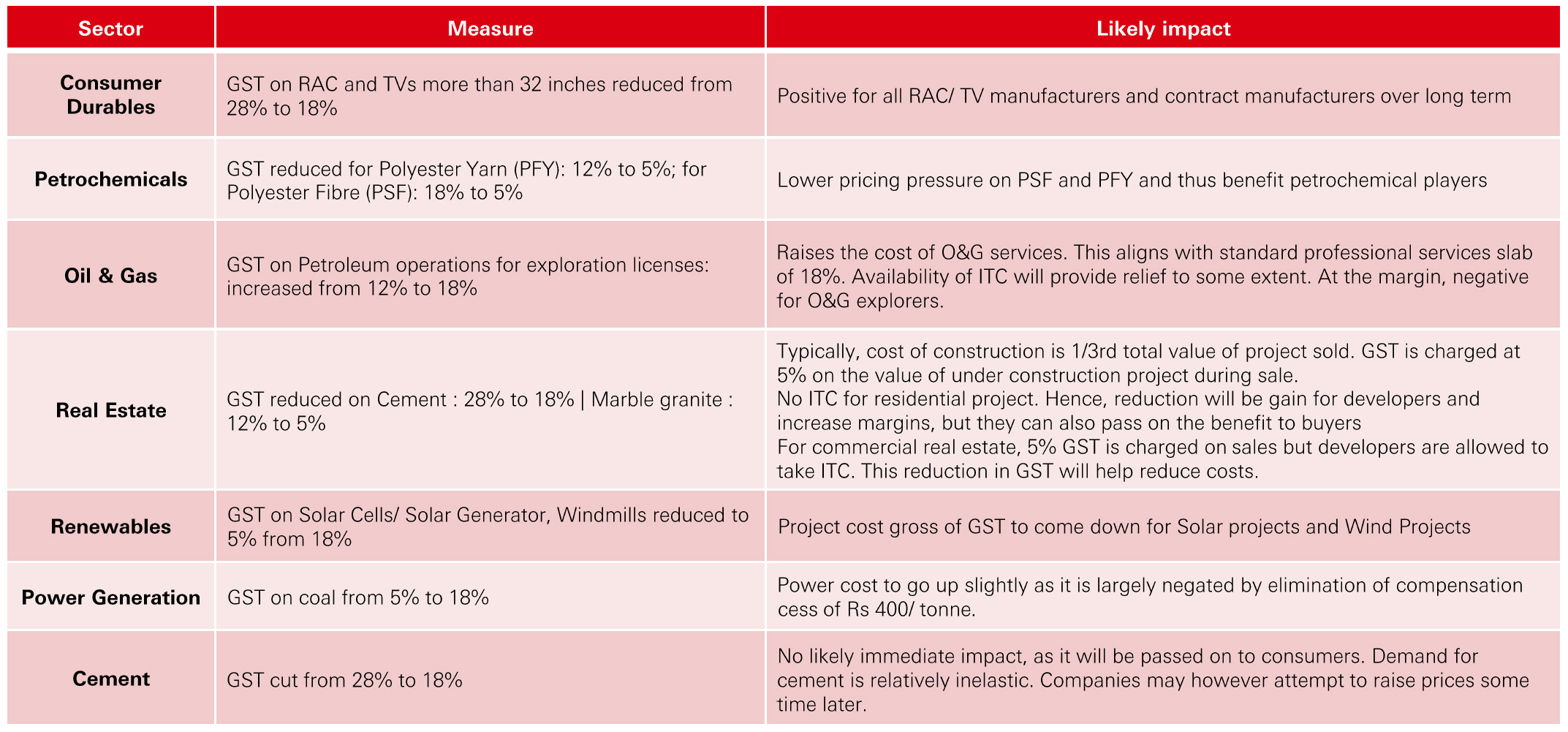

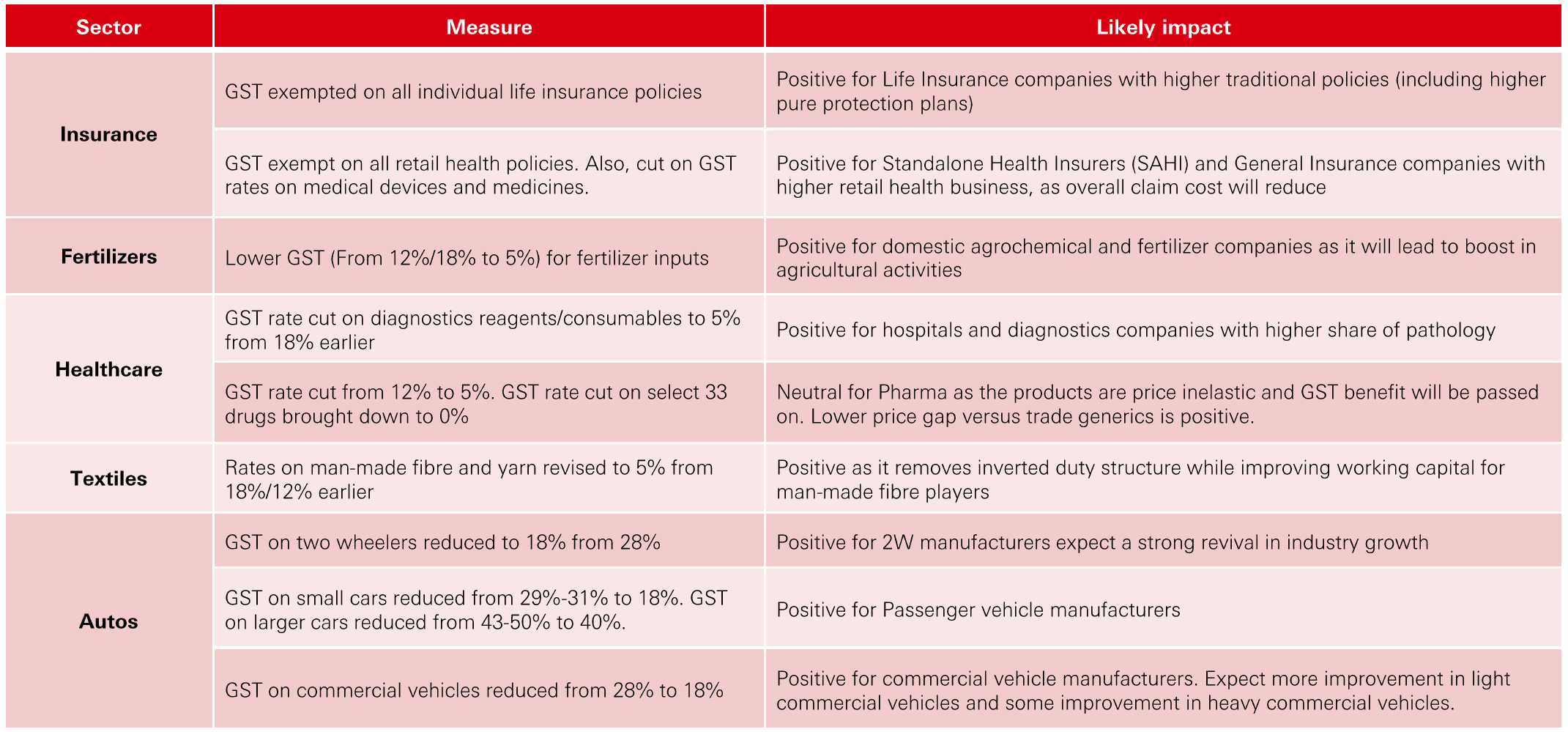

Key sector impact and assessment

Click the image to enlarge

Click the image to enlarge

Click the image to enlarge

Source: Government of India, HSBC Mutual Fund

Economic momentum to continue

Renewed push to drive consumption

Our Take

- We continue to remain positive on Consumption, especially discretionary consumption

- Over the past few years, Consumption sector was already seeing tailwinds with shift from unorganized to organized, premiumization, convenience, middle class aspirations, digitalization/ smartphone penetration, nuclearization, etc.

- Since the beginning of 2025, we see low inflation, rate cuts, good monsoons and harvest season, government’s social welfare schemes, easing RBI regulations resulting in better system liquidity and now GST cuts giving additional levers for consumption growth

- In our view, as consumption demand may improve further, strong corporate balance sheets and higher capacity utilization levels should kick-start the private capex cycle

- Overall, we remain positive on India’s long-term growth outlook with strong government push towards reforms, led by 3 key pillars of Consumption, Capex (both government and private) and Financialization

Source: Government of India, HSBC Mutual Fund

Important information

Note: Data and estimates as on Sept. 4, 2025 or as latest available.

Any views expressed were held at the time of preparation and are subject to change without notice. While any forecast, projection or target where provided is indicative only and not guaranteed in any way. HSBC Asset Management India accepts no liability for any failure to meet such forecast, projection or target. Past performance is not a reliable indicator of future performance.

Disclaimer: This document has been prepared by HSBC Asset Management (India) Private Limited (HSBC) for information purposes only and should not be construed as i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or ii) an offer to sell or a solicitation or an offer for purchase of any of the funds of HSBC Mutual Fund; or iii) an investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment or investment strategies that may have been discussed or referred herein and should understand that the views regarding future prospects may or may not be realized. In no event shall HSBC Mutual Fund/HSBC Asset management (India) Private Limited and / or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information / opinion herein. This document is intended only for those who access it from within India and approved for distribution in Indian jurisdiction only. Distribution of this document to anyone (including investors, prospective investors or distributors) who are located outside India or foreign nationals residing in India, is strictly prohibited. Neither this document nor the units of HSBC Mutual Fund have been registered under Securities law/Regulations in any foreign jurisdiction. The distribution of this document in certain jurisdictions may be unlawful or restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions. If any person chooses to access this document from a jurisdiction other than India, then such person do so at his/her own risk and HSBC and its group companies will not be liable for any breach of local law or regulation that such person commits as a result of doing so.

Investors are requested to note that as per SEBI (Mutual Funds) Regulations, 1996 and guidelines issued thereunder, HSBC AMC, its employees and/or empaneled distributors/agents are forbidden from guaranteeing/promising/assuring/predicting any returns or future performances of the schemes of HSBC Mutual Fund. Hence please do not rely upon any such statements/commitments. If you come across any such practices, please register a complaint via email at investor.line@mutualfunds.hsbc.co.in.

The above information is for illustrative purposes only. The sector(s) mentioned in this document do not constitute any research report nor it should be considered as an investment research, investment recommendation or advice to any reader of this content to buy or sell any stocks / investments.

Document intended for distribution in Indian jurisdiction only and not for outside India or to NRIs. HSBC MF will not be liable for any breach if accessed by anyone outside India. For more details, click here / refer website.

© Copyright. HSBC Asset Management (India) Private Limited 2025, ALL RIGHTS RESERVED.

HSBC Mutual Fund, 9-11th Floor, NESCO - IT Park Bldg. 3, Nesco Complex, Western Express Highway, Goregaon East, Mumbai 400063. Maharashtra.

GST - 27AABCH0007N1ZS | Website: www.assetmanagement.hsbc.co.in

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.