CEO Speak August 2025

Through the Looking Glass: Navigating Markets Amid Shifting Realities

Peering through the looking glass of today’s financial world, we see an environment as unpredictable as Wonderland itself where Alice had stepped into.

August 2025 has been marked with increased volatility in the markets with the current geopolitical and trade uncertainties. Despite India’s robust economic fundamentals, the Indian markets saw significant capital outflows by FIIs fuelled by global investor anxiety. Interestingly, while FIIs sold heavily in the secondary market, they remained active in IPOs, buying crores worth of equities through the primary route. In an interconnected world, we cannot completely shield ourselves against the effects and fall outs of developing situations across the globe. Yet, the Indian economy continues to be on its growth track, and the markets have also shown resilience over time.

India’s GDP (gross domestic product) growth is still at 7.4 per cent (YoY) in Q425 and even with the tariff changes the outlook and projection does not show a drastic decrease. It is expected to carry on with the momentum gained last year. The government and the Reserve Bank of India are also taking measures and continued efforts to boost private consumption, liquidity in the markets and support to small and medium enterprises. Income tax rate cuts, RBI’s monetary policies, GST reforms are all aligned to the over arching goal of boosting the Indian economy.

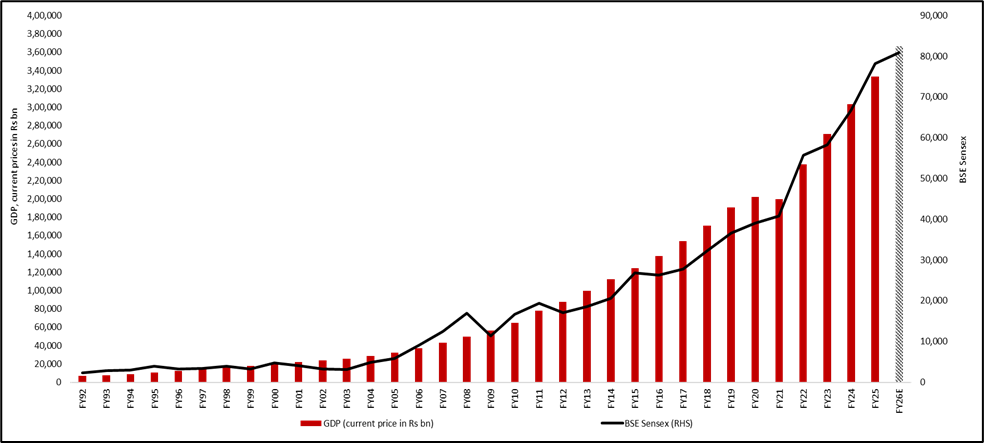

Through the GDP lens

Over the last many years, India’s stock markets have broadly mirrored the trajectory of the country’s GDP growth. Periods of strong economic expansion—driven by consumption, infrastructure investment, and digital adoption—have coincided with bull phases in equities, while slowdowns or external shocks have translated into market corrections. The long-term trend shows that as India’s GDP has steadily grown to make it one of the world’s fastest-expanding large economies, equity indices too have compounded wealth, reinforcing the link between economic growth and market performance. Hence, investors should keep their focus on their long-term financial goals, continue with their SIPs and not react to market cycles.

Source: Crisil, Bloomberg, BSE, IMF, The GDP projection for fiscal year 2026 is shown shaded in this graph is for illustration purposes only and is not guaranteed. Data as on 29 August 2025, Past Performance May or May not be sustained in future. Note-The details provided above are as per the information available in public domain at this moment and subject to change.

Through the sectoral performance lens

Over the last one-year, sectoral performance in India has been a story of sharp contrasts. Financial services and banking led the pack with healthy double-digit gains, supported by strong credit growth and resilient balance sheets. Healthcare too delivered steady positive returns, buoyed by global demand and domestic consumption. On the other hand, globally linked sectors such as IT, Oil & Gas, and Autos came under pressure, while Realty and Media saw some of the steepest declines. Interestingly, gold and silver emerged as strong outperformers, highlighting the importance of diversification.

As an investor, asset allocation and investing in sectoral/thematic funds as per one’s risk appetite and financial goals can have a directional impact on your overall portfolio of investments.

What this means for Mutual Fund investors:

- Rising Domestic Resilience

The market’s resilience is being bolstered by domestic flows—DIIs and SIPs—which provide a stabilizing influence amid FPI sell-offs - Sector Tilt Matters

Fund managers and investors appear to support sectors rooted in domestic demand. A growing trend of outperforming sector-specific funds versus broad indices suggests active, theme-aware investing is another option in an investor portfolio for those who want to take the risk - Diversify Beyond Equities

Given bullion’s robust performance, precious metals may be considered as effective hedges in portfolios - SIP Discipline Pays Off

The consistency of SIP inflows even during a volatile August demonstrates the strength of disciplined investing and rupee-cost averaging—key mechanisms for navigating uncertainty

Much like Alice stepping through the looking glass into a world of shifting shapes and curious characters, investors too must navigate this landscape of surprises and contradictions. Yet, even amidst the uncertainties, a careful gaze through the looking glass reveals resilience, opportunity, and steady threads of growth.

Happy Investing and Stay Invested.

Investors are requested to note that as per SEBI (Mutual Funds) Regulations, 1996 and guidelines issued thereunder, HSBC AMC, its employees and/or empanelled distributors/agents are forbidden from guaranteeing/promising/assuring/predicting any returns or future performances of the schemes of HSBC Mutual Fund. Hence please do not rely upon any such statements/commitments. If you come across any such practices, please register a complaint via email at investor.line@mutualfunds.hsbc.co.in.

Views provided above are based on information in public domain and subject to change. Investors are requested to consult their financial advisor for any investment decisions.

Source: HSBC MF, CRISIL. Data as on August 2025 end or as latest available

Disclaimer:This document has been prepared by HSBC Asset Management (India) Private Limited (HSBC) for information purposes only and should not be construed as i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or ii) an offer to sell or a solicitation or an offer for purchase of any of the funds of HSBC Mutual Fund; or iii) an investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment or investment strategies that may have been discussed or referred herein and should understand that the views regarding future prospects may or may not be realized. In no event shall HSBC Mutual Fund/HSBC Asset management (India) Private Limited and / or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information / opinion herein.

This document is intended only for those who access it from within India and approved for distribution in Indian jurisdiction only. Distribution of this document to anyone (including investors, prospective investors or distributors) who are located outside India or foreign nationals residing in India, is strictly prohibited. Neither this document nor the units of HSBC Mutual Fund have been registered under Securities law/Regulations in any foreign jurisdiction. The distribution of this document in certain jurisdictions may be unlawful or restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions. If any person chooses to access this document from a jurisdiction other than India, then such person do so at his/her own risk and HSBC and its group companies will not be liable for any breach of local law or regulation that such person commits as a result of doing so.

The above information is for illustrative purposes only. The sector(s) mentioned in this document do not constitute any research report nor it should be considered as an investment research, investment recommendation or advice to any reader of this content to buy or sell any stocks / investments.

© Copyright. HSBC Asset Management (India) Private Limited 2025, ALL RIGHTS RESERVED. All third party trademarks (including logos and icons) remain the property of their respective owners. Use of it does not imply any affiliation with or endorsement by them.

HSBC Mutual Fund, 9-11th Floor, NESCO - IT Park Bldg. 3, Nesco Complex, Western Express Highway, Goregaon East, Mumbai 400063. Maharashtra.

GST - 27AABCH0007N1ZS | Website: www.assetmanagement.hsbc.co/in

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

CL 3180

![]() To Transact on WhatsApp – Send us “Hi” on 9326929294 TnC

To Transact on WhatsApp – Send us “Hi” on 9326929294 TnC

![]() For Product updates on WhatsApp – Send us “Hi” on 8879900800

TnC

For Product updates on WhatsApp – Send us “Hi” on 8879900800

TnC

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.