CEO Speak

Stay or Exit? A Conversation every investor needs to hear.

Neil banged his phone down and sighed. Maya his colleague sitting across the table got startled, looked at him and asked, “What happened Neil?” Neil replied, “I have had enough adventure with my mutual fund portfolio. It is in red, and the markets are falling continuously. I think I need to cut my losses and exit while there is still some value left in my funds. This does not look good!” Maya, in a calm voice said “Yeah! The markets have been choppy, my portfolio is down too. But I am not planning to withdraw as I am here for long term. Why don’t we talk over a cup of coffee in the cafeteria downstairs?”

In the cafeteria, Maya asked Neil “Tell me when you invested in the mutual funds and why?”

Neil promptly said “a year back. I had started 3 SIPs, you know, saw some advertisements, everyone was talking about mutual funds, also thought that it would be a good idea to get better returns considering my recurring deposits barely give me 6 per cent return. Saving regular from my monthly salary also seemed like a good idea …. but now the value is going down every month.”

Maya: “I get your concern, but let me ask you something—when you go on a long road trip and hit a few potholes, do you turn back home?”

Neil: “Well, no. But this isn’t a road trip, this is my hard-earned money!”

Maya: “Exactly! And that’s why you need to let it grow. The market moves in cycles—ups and downs are normal. If you exit now, you’ll book losses. Historically, markets recover over time, and patience has rewarded investors who stay invested. I have been investing in mutual funds through SIPs for over 12 years now. Infact, I have gradually increased my monthly investment into SIPs as my salary increased over the years. Despite the market ups and downs, my portfolio has grown substantially well”.

Neil: But what if the market falls even further?

Maya: “It may, we don’t know. No one can predict the markets but that is the beauty of SIPs. When the markets fall, we end up buying more units. When the markets rise, we buy lesser units. Thats rupee cost averaging. So, when market rises, you may get better returns. No one can time the market. But history shows that after every downturn, markets bounce back stronger. If you exit now and the market recovers, you might miss the best days of growth.”

Neil: Yes… I’ve read about that. They say missing just a few of the best days can drastically reduce overall returns.

Maya: Right! Let me give you an example. If someone had invested in the Sensex 15 years ago and stayed invested, they would have seen their money multiply several times over. But if they had panicked and withdrawn during every market dip, they would have lost out on significant gains.

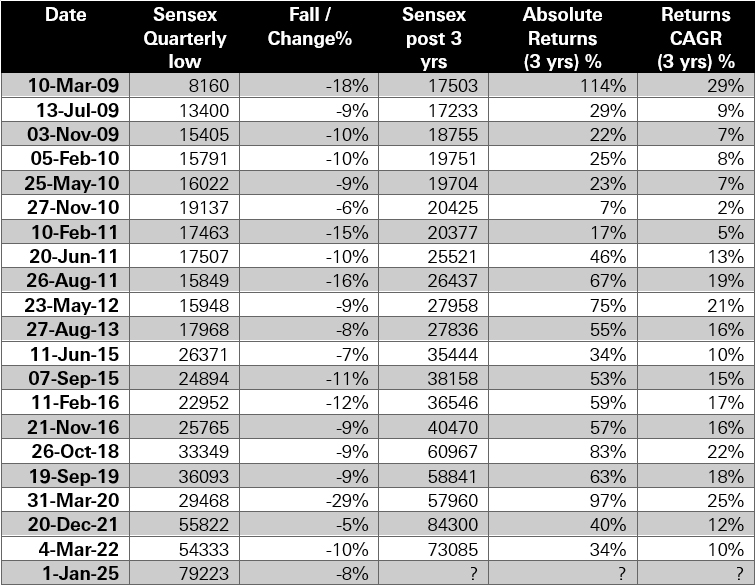

During the first quarter of 2009, Sensex has corrected by 18 per cent due to the global financial crisis of 2008 - 09. But after experiencing 18 per cent market correction, Sensex has delivered 114 per cent absolute returns (29 per cent CAGR) over the next 3 years as of March 2012.

Here look at this chart.” Maya showed her the below chart on her phone that gives the data of the times the markets have corrected more than 5 per cent and then how they have given returns in the subsequent 3 years.

Quarterly period – Jan – March, Apr – Jun, Jul – Sep, Oct to Dec. 1st and last day of quarter.

Past performance may or may not be sustained in future and is not a guarantee of any future returns.

Do you see how many times the markets have significantly corrected in the past years but bounced back with good returns if one stayed invested for a long time.

Neil: That makes sense. But what if I need the money soon?

Maya: If your goal is short-term, then yes, equity mutual funds may not be ideal. That’s why it’s important to match investments with your financial goals. But if you invested for the long term, short-term volatility shouldn’t hassle you. You have a little baby now Neil, think of these SIPs as building your corpus for your child’s education. Easily 15 years from now. That is called having a financial goal for any investment.

Neil: I see your point. I was reacting emotionally instead of thinking long-term.

Maya: Exactly! Investing is like planting a tree. If you keep uprooting it whenever a storm comes, it will never grow. Long-term investors stay through the rough patches and see better returns.

Neil: You’re right. I’ll stay invested and focus on my financial goal. Thanks for talking to me Maya.

Maya: It happens to everyone. But wealth grows with patience. Stay invested and let time work for you.

They got back to work, Neil felt much more settled after having this conversation with Maya. If you ever come across a ‘Neil’—worried and unsure—be the ‘Maya’ who offers clarity.

Source: Bloomberg, ICRA MFI, HSBC Mutual Fund, Data as on 5 March 2025 unless otherwise given. * Period between 01 Jan ’25 to 4 Mar ’25.

Past performance may or may not be sustained in the future and is not indicative of future results.

Investors are requested to note that as per SEBI (Mutual Funds) Regulations, 1996 and guidelines issued thereunder, HSBC AMC, its employees and/or empanelled distributors/agents are forbidden from guaranteeing/promising/assuring/predicting any returns or future performances of the schemes of HSBC Mutual Fund. Hence please do not rely upon any such statements/commitments. If you come across any such practices, please register a complaint via email at investor.line@mutualfunds.hsbc.co.in.

Views provided above are based on information in public domain and subject to change. Investors are requested to consult their financial advisor for any investment decisions.

Disclaimer: This document has been prepared by HSBC Asset Management (India) Private Limited (HSBC) for information purposes only and should not be construed as i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or ii) an offer to sell or a solicitation or an offer for purchase of any of the funds of HSBC Mutual Fund; or iii) an investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment or investment strategies that may have been discussed or referred herein and should understand that the views regarding future prospects may or may not be realized. In no event shall HSBC Mutual Fund/HSBC Asset management (India) Private Limited and / or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information / opinion herein.

This document is intended only for those who access it from within India and approved for distribution in Indian jurisdiction only. Distribution of this document to anyone (including investors, prospective investors or distributors) who are located outside India or foreign nationals residing in India, is strictly prohibited. Neither this document nor the units of HSBC Mutual Fund have been registered under Securities law/Regulations in any foreign jurisdiction. The distribution of this document in certain jurisdictions may be unlawful or restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions. If any person chooses to access this document from a jurisdiction other than India, then such person do so at his/her own risk and HSBC and its group companies will not be liable for any breach of local law or regulation that such person commits as a result of doing so.

© Copyright. HSBC Asset Management (India) Private Limited 2025, ALL RIGHTS RESERVED. All third party trademarks (including logos and icons) remain the property of their respective owners. Use of it does not imply any affiliation with or endorsement by them.

HSBC Mutual Fund, 9-11th Floor, NESCO - IT Park Bldg. 3, Nesco Complex, Western Express Highway, Goregaon East, Mumbai 400063. Maharashtra.

GST - 27AABCH0007N1ZS | Website: www.assetmanagement.hsbc.co/in

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

CL 2488

![]() To Transact on WhatsApp – Send us “Hi” on 9326929294 TnC

To Transact on WhatsApp – Send us “Hi” on 9326929294 TnC

![]() For Product updates on WhatsApp – Send us “Hi” on 8879900800

TnC

For Product updates on WhatsApp – Send us “Hi” on 8879900800

TnC

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.