Success!

Your information was saved successfully!ErrorHeader

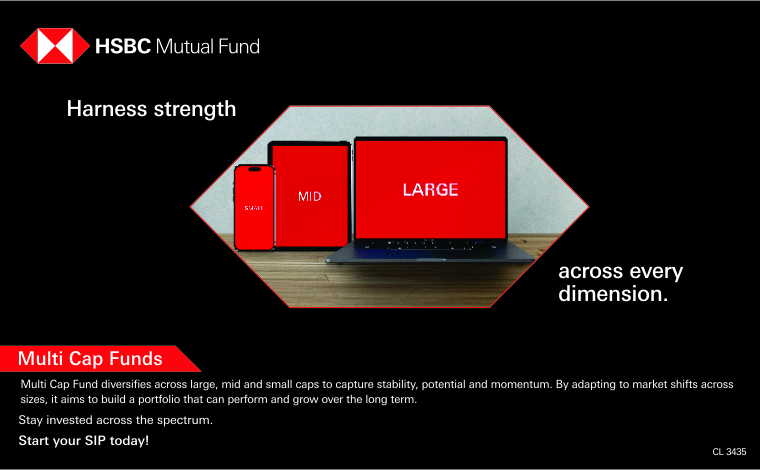

ErrorSubHeaderSIP Hai #FaydeWaliAadat – it's the disciplined habit of Systematic Investment Plan (SIP) that provides opportunity for gradual financial growth over time. Just like any positive habit, SIPs require patience and consistency, bringing your financial goals closer to reality. Cultivate this #FaydeWaliAadat for a secure financial future.

How to Start an SIP

SIP is easy when you know how much you want to invest, and it also helps when you know how often you want to invest. When you don't want to invest a "considerably big" amount, a systematic investment plan can significantly help.

01

Choose your investment amount

02

Select your investment range

03

Set your starting date

04

Pick mutual fund amount for your SIP

Watch millennials unlock SIP Hai #FaydeWaliAadat

The Burger StoryIn 'The Burger Story,' we delve into millennials' ambitious dreams. A friend's Bollywood dream in Spain clashes with daily burger indulgence, sparking a wise realization that embracing SIPs over spending can make short-term dreams come true. |

The Dream Home"The Dream Home" reveals millennials' impulsive shopping habits, particularly fast fashion. A friend dreams of a home with a walk-in closet, but impulsive spending hinders this goal. The solution? Redirect expenses to SIPs for an effective path to that dream home. |

The Gadget GuruA friend with wild startup ideas faces a feasibility challenge. The protagonist, noting the friend's excessive tech spending, emphasizes the importance of curbing these expenses and adopting the SIP habit for financial stability and entrepreneurial success. |

Benefits of SIP #FaydeWaliAadat |

|

|

|

|

Resources

|

|

|

|

|

|

|

An Investor Education & Awareness Initiative by HSBC Mutual Fund

Visit https://www.assetmanagement.hsbc.co.in/en/mutual-funds/investor-resources/information-library/know-your-customer w.r.t. one-time Know Your Customer (KYC) process, complaints redressal process including SEBI SCORES (https://www.scores.gov.in). Investors should only deal with Registered Mutual Funds, to be verified on SEBI website under Intermediaries/Market Infrastructure Institutions (https://www.sebi.gov.in/intermediaries.html). Investors may refer to the section on ‘Investor Education’ on the website of HSBC Mutual Fund for the details on all ‘Investor Education and Awareness Initiatives’ undertaken by HSBC Mutual Fund.

This document is intended only for distribution in Indian jurisdiction. Neither this document nor the units of HSBC Mutual Fund have been registered under Securities law/Regulations in any foreign jurisdiction. The distribution of this document in certain jurisdictions may be unlawful or restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions. If any person chooses to access this document from a jurisdiction other than India, then such person do so at his/her own risk and HSBC and its group companies will not be liable for any breach of local law or regulation that such person commits as a result of doing so.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.