India is becoming a major driving force in the world economy. In nominal GDP terms, India is the 5th largest country globally and is projected to become 3rd largest by 2030. India's financial services sector, from banking and insurance to asset management and fintech, is poised for significant growth driven by country’s rapidly expanding economy, offering immense opportunities for wealth creation.

The banking sector is considered the backbone of the Indian economy, playing a crucial role in economic growth and development whereas other segment of financial services sector is on a growth trajectory, driven by increasing financial inclusion, digitalization, and supportive regulatory policies. These factors contribute to the potential for robust growth in the sector, making it an attractive proposition for investors seeking to capitalize on the sector's performance.

Source: RBI, Financial Stability Board, World Bank, Federal Reserve, Bundesbank, BCG analysis

New Fund Offer: Presenting HSBC Financial Services Fund

HSBC Financial Services Fund is a sectoral fund that aims to generate long-term capital appreciation from a portfolio that is invested predominantly in equity and equity related securities of companies engaged in financial services businesses.

Financial Services Sector companies include:

|

Banks and Non-Banking Financial Institutions

|

Stock Broking and Allied Entities

|

Asset Management Company(s)

|

Depositories

|

Credit Rating Agencies

|

Clearing Houses and Other Intermediaries

|

|

Financial Technology (Fintech), Exchanges and Data Platforms

|

Investment Banking Companies

|

Wealth Management Entities

|

Distributors of Financial Products

|

Insurance Companies - General, Life

|

Microfinance, Housing Finance and payment companies

|

Companies engaged in the Financial Services sector from Sector list provided by AMFI/SEBI in Industry Classification data or other financial services as identified by Fund Manager, etc.

Source: HSBC Mutual Fund, Note - Please refer to Scheme Information Document (SID) for more details on Investment Approach and other details.

Invest now

Portfolio Construction Approach

Source: HSBC Mutual Fund. The above details provided basis on sourced information only. The sector(s) mentioned in this document do not constitute any research report nor it should be considered as an investment research, investment recommendation or advice to any reader of this content to buy or sell any stocks / investments. The Fund/portfolio may or may not have any existing / future position in these sector(s)/stock(s)/issuer(s). Past performance may or may not be sustained in future and is not a guarantee of any future returns.

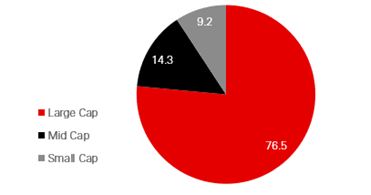

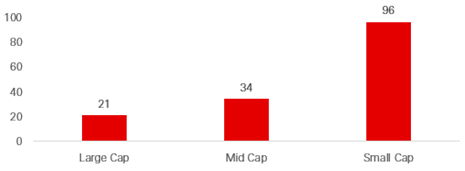

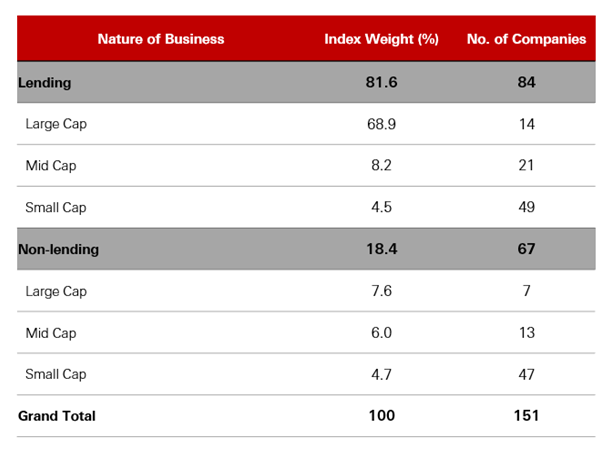

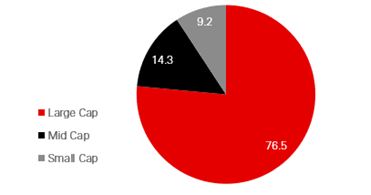

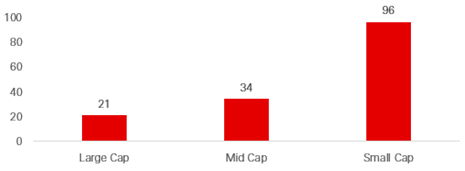

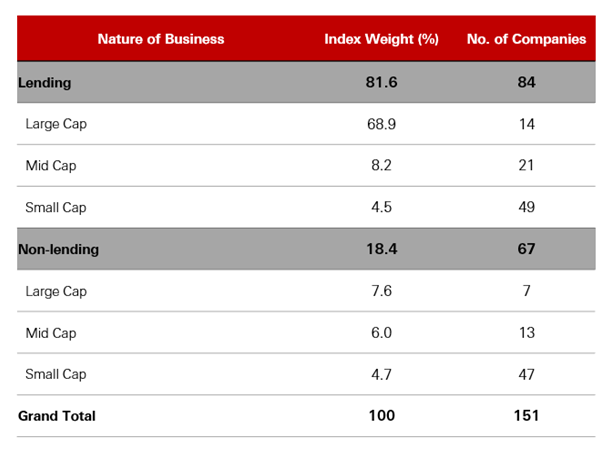

Benchmark Composition – BSE Financial Services Index

Index Weight (per cent)

No. of Companies

|

|

Source: HSBC Mutual Fund analysis, BSE Financial Services Index constituents as of 31 December 2024. The sector(s)/stock(s)/issuer(s) mentioned in this document do not constitute any research report nor it should be considered as an investment research, investment recommendation or advice to any reader of this content to buy or sell any stocks / investments. The Fund/portfolio may or may not have any existing / future position in these sector(s)/stock(s)/issuer(s). Past performance may or may not be sustained in future and is not a guarantee of any future returns.

Fund Details

|

Scheme Type: An open-ended equity scheme investing in financial services sector

|

|

Investment Objective: The investment objective of the scheme is to generate long-term capital appreciation from a portfolio that is invested predominantly in equity and equity related securities of companies engaged in financial services businesses. There is no assurance that the investment objective of the scheme will be achieved.

|

|

Benchmark (Tier 1): As per AMFI Tier 1 benchmark Index – BSE Financial Services Total Return Index (TRI)

|

|

Fund Manager: Ms. Gautam Bhupal (For Domestic equities)

|

Invest now

Fund Infographics

Infographics

Resources

FAQ

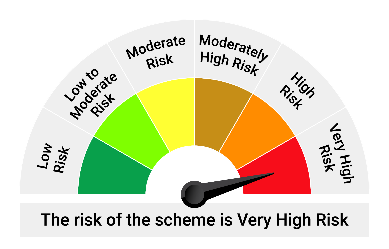

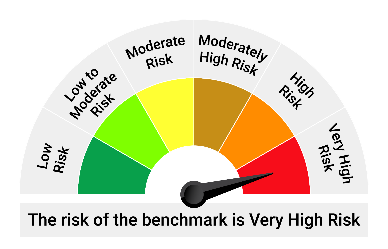

Product Label and Disclaimer

|

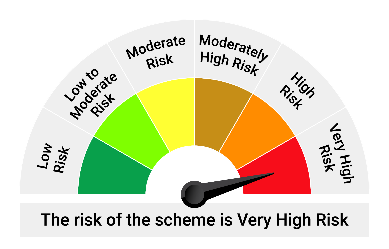

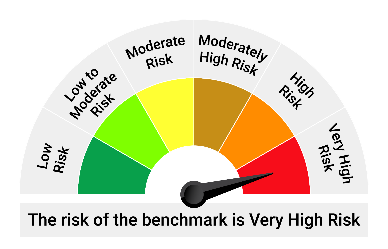

HSBC Financial Services Fund

(An open-ended equity scheme investing in financial services sector)

This product is suitable for investors who are seeking*:

• To create wealth overlong term

• Investment predominantly in equity and equity related securities of companies engaged in financial services businesses

|

|

As per AMFI Tier | Benchmark

i.e. Benchmark Index: BSE Financial Services TRI

|

|

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

|

The product labelling assigned during the New Fund Offer (NFO) is based on internal assessment of the Scheme characteristics or model portfolio and the same may vary post NFO when the actual investments are made.

Source: HSBC Mutual Fund. Please refer to Scheme Information Document (SID) for more details.

Past performance may or may not be sustained in the future and is not indicative of future results.

Views provided above are based on information provide in public domain at this moment and subject to change. Investor should consult their financial advisor for any investment decision applicable to their investment appetite.

Investors are requested to note that as per SEBI (Mutual Funds) Regulations, 1996 and guidelines issued thereunder, HSBC AMC, its employees and/or empaneled distributors/agents are forbidden from guaranteeing/promising/assuring/predicting any returns or future performances of the schemes of HSBC Mutual Fund. Hence please do not rely upon any such statements/commitments. If you come across any such practices, please register a complaint via email at investor.line@mutualfunds.hsbc.co.in.

Source of map: www.surveyofindia.gov.in

Map of India is used for illustrative purpose only and is not a political map of India.

Note: The above information is for illustrative purposes only. The sector(s)/issuer(s) mentioned in this document do not constitute any research report nor it should be considered as an investment research, investment recommendation or advice to any reader of this content to buy or sell any stocks/ investments. Please refer Scheme Information Document (SID) for more details.

Disclaimer: This document has been prepared by HSBC Mutual Fund for information purposes only and should not be construed as i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or ii) an offer to sell or a solicitation or an offer for purchase of any of the funds of HSBC Mutual Fund; or iii) an investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment or investment strategies that may have been discussed or referred herein and should understand that the views regarding future prospects may or may not be realized. In no event shall HSBC Mutual Fund/HSBC Asset management (India) Private Limited and / or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information / opinion herein.

This document is intended only for those who access it from within India and approved for distribution in Indian jurisdiction only. Distribution of this document to anyone (including investors, prospective investors or distributors) who are located outside India or foreign nationals residing in India, is strictly prohibited. Neither this document nor the units of HSBC Mutual Fund have been registered under Securities law/Regulations in any foreign jurisdiction. The distribution of this document in certain jurisdictions may be unlawful or restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions. If any person chooses to access this document from a jurisdiction other than India, then such person do so at his/her own risk and HSBC and its group companies will not be liable for any breach of local law or regulation that such person commits as a result of doing so.

© Copyright. HSBC Asset Management (India) Private Limited 2024, ALL RIGHTS RESERVED.

HSBC Mutual Fund, 9-11th Floor, NESCO - IT Park Bldg. 3, Nesco Complex, Western Express Highway, Goregaon East, Mumbai 400063. Maharashtra.

GST - 27AABCH0007N1ZS, Email: investor.line@mutualfunds.hsbc.co.in | Website: www.assetmanagement.hsbc.co.in

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

CL 2312