HSBC Aspire Portfolio

HSBC Portfolio Management Services presents HSBC Aspire Portfolio, which aims to invest your money in emerging themes from Mid and Small Caps to which may lead in the next decade.

So don’t miss out on this opportunity to make the most from this decade.

HSBC Aspire Portfolio

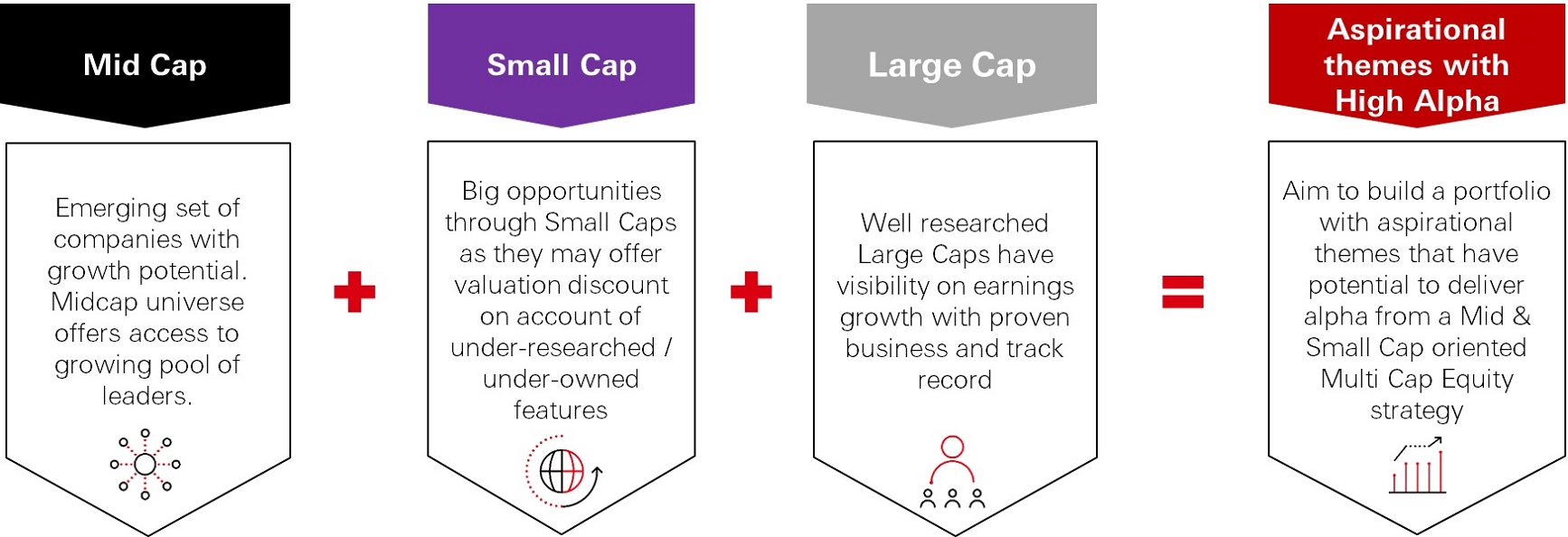

Aspirational themes from Mid and Small Caps with flavor of quality Large Caps

Why Mid and Small Caps?

- Stocks from relatively new sectors are getting listed and many of these are mid and small caps

- Stocks from relatively new sectors are getting listed and many of these are mid and small caps

- India gaining traction as a manufacturing source would mean opportunities for a lot of ancillary sectors which would be smaller in size

- Historically, Mid and Small Caps have delivered reasonable performance over medium to long term

- Small and Mid Caps are good options to hold emerging business leaders. More Mid-Small cap businesses are dependent on domestic factors

- Mid and Small Caps offer potential of delivering growth and alpha in the long term

Why Invest in HSBC Aspire Portfolio

- Quality

The portfolio aims to gain by focusing on Quality Business with robust growth & competitive advantages: High quality products, brands, franchise with scalability and resilience. - Sustainability

Sustainable earning growth & return ratios: We prefer companies with superior earnings growth profile with high ROE/ROCE with low gearing. - Valuations

Fair Valuations: Identifying a scrip at fair value before its future earnings growth is reflected in its “valuation” is an art which helps in generating portfolio “Alpha”. - Ownership

Promoter holding: Invests into businesses with reasonable promoter holding. The management with passion and have skin in the game are expected to deliver performance over the period of time. - Governance

Corporate governance a key to long term success: Transparent, passionate & honest management helps in multiplying wealth in the long term. Capital efficiency reflects the management skills.

For illustrative purposes only, The information above is provided by and represents the opinions of HSBC Asset Management and is subject to change without notice.

Investment Approach: HSBC Aspire Portfolio (HASP)

Investment Objective

HSBC Aspire Portfolio aims to generate long-term capital growth from an actively managed portfolio of equity and equity related securities predominately from the mid and small cap companies. However, the approach would also have the flexibility to invest in companies across the entire market capitalization spectrum. There can be no assurance or guarantee the objective of the investment approach would be achieved

Description of types of securities

- Equity and equity related securities including convertible bonds and debentures and warrants carrying the right to obtain equity shares

- Derivatives instruments as may be permitted by SEBI / RBI

- Units of liquid funds/overnight funds of HSBC Mutual Fund

- Cash and Cash equivalents

- Any other instruments as may be permitted by RBI / SEBI / such other Regulatory authorities from time to time

Basis of selection of types of securities

The investment approach seeks to invest in mid cap and small cap companies with a flexibility to invest in companies across the entire market capitalization spectrum, if required. The portfolio manager intends to do the same by buying equities of these companies and hence, equity and equity related securities are chosen for investment. The portfolio manager will focus on companies which have potential to deliver high

Allocation of portfolio across types of securities:

The investment approach has the mandate to predominantly invest in Equity and Equity related instruments of mid cap and small cap companies. However, the investment approach has the flexibility to invest in companies across the entire market capitalization spectrum.

Benchmark Index for comparison of performance:

- Regulatory Benchmark/ Strategy Benchmark: S&P BSE 500 TRI

- Secondary Benchmark: Nifty MidSmall 400 Index

Rationale for selection of benchmark

Regulatory Benchmark/ Strategy Benchmark: Benchmark prescribed by Association of Portfolio Managers in India (APMI) as mandated by SEBI to evaluate relative performance of the portfolio. This is decided by APMI as per market-cap based methodology for equity strategy.

Secondary Benchmark: The portfolio is also being benchmarked against the Nifty MidSmall 400 Index since its composition is in line with the objective of the investment approach. The index comprises of mid and small cap companies and is also suited for comparing the performance of the portfolio.

Indicative tenure or investment horizon

Medium to Long Term (5 years+)

Risk associated with investment approach

Deployment of monies under the investment approach will be oriented towards equity and equity related securities of companies belonging to mid cap and small cap. Stocks of these companies usually have lower trading volumes on the exchanges, which may result into higher impact costs and longer execution time compared to large cap stocks. These companies tend to be less researched compared to large cap stocks and this may result into longer waiting period for the stock to reach their potential intrinsic value. A lot of smaller companies can be highly volatile and hence tend to have large up and down movements which may result in periods where the investor may see drawdowns. Further, small cap companies have higher opportunities of growth but these come with higher amount of risk as well and therefore, are suitable only for those investors who have higher risk appetite. It is likely that the portfolio may also experience period of volatile performance and liquidity challenges in view of its exposure towards mid and small cap companies. These companies will also be affected by the broader macro-economic environment such as interest rate changes, liquidity, cross border fund flows, statutory/ regulatory changes etc.

Investors should note that pursuant to Clause 2.3 of SEBI Master circular dated March 20, 2023, investors have an option to invest directly i.e. without intermediation of persons engaged in distribution services.

Note - Past performance may or may not be sustained in the future. Source – HSBC Asset Management India.